Understanding Cascading Crypto Liquidations: The $19B Crash Explained [Why It’s the Perfect Time to Launch a KOL Campaign]

This comprehensive guide breaks down the mechanics of cascading liquidations, examines the historic October crash, and reveals why this market cleanse opens the door for explosive Q4 growth.

The crypto market just witnessed its largest single-day liquidation event in history. On October 10-11, 2025, over $19 billion in leveraged positions evaporated in hours, leaving 1.7 million traders in the red and sending shockwaves through the digital asset ecosystem.

Yet paradoxically, this "leverage reset" has positioned crypto for one of its strongest recovery phases yet, creating unprecedented opportunities for brands, projects, and marketers who know how to capitalize on renewed market momentum.

If you're a crypto project founder, marketing manager, or growth strategist trying to understand what just happened and how to navigate the aftermath, this comprehensive guide breaks down the mechanics of cascading liquidations, examines the historic October crash, and reveals why this market cleanse opens the door for explosive Q4 growth.

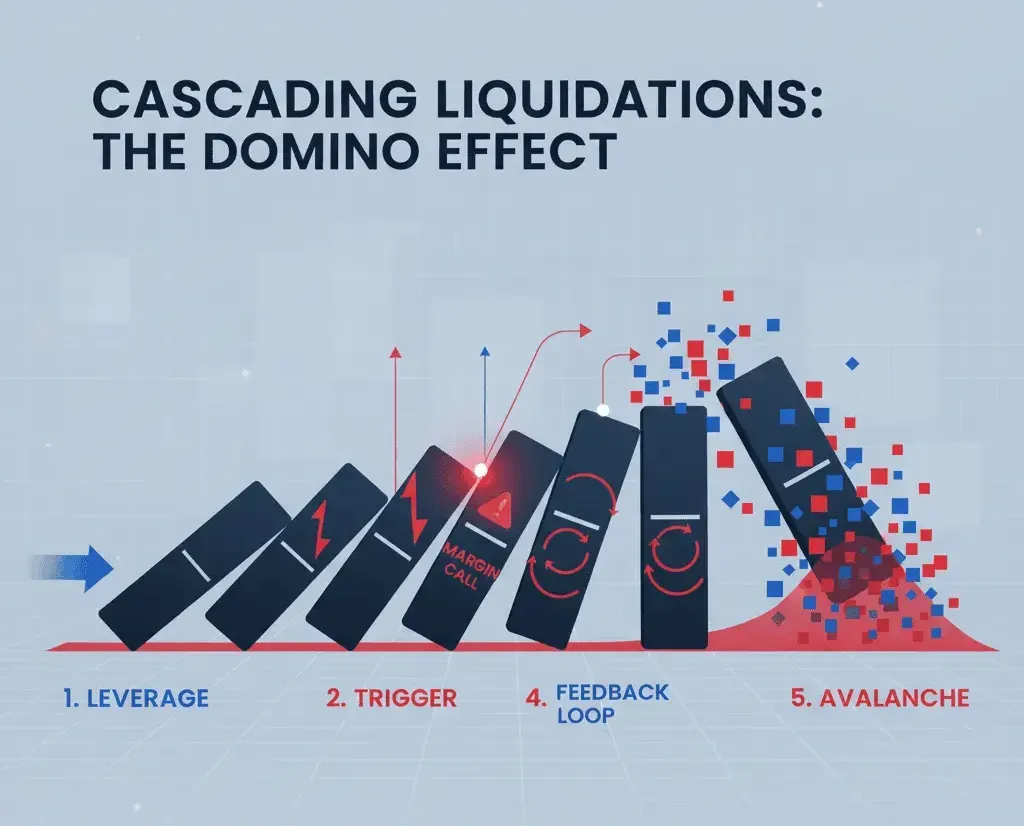

What Are Cascading Liquidations? The Domino Effect Explained

Cascading liquidations represent one of crypto's most devastating and misunderstood phenomena. Understanding the mechanism is crucial for anyone building or marketing in this space.

The Five-Stage Cascade Process

Stage 1: Leveraged Positioning

Traders use borrowed capital to amplify their market exposure. With 10x leverage, a $10,000 position controls $100,000 worth of assets. This amplification works both ways, magnifying profits but also accelerating losses at the same ratio.

Stage 2: The Initial Trigger

A market shock (whether geopolitical news, regulatory announcements, or technical breakdown) causes a sharp price movement. This trigger doesn't need to be massive. In illiquid markets, even modest sell pressure can destabilize prices.

Stage 3: Margin Threshold Breaches

As prices move against leveraged positions, traders' collateral value drops. When it falls below the exchange's maintenance margin requirement (typically 3-10% of position value), automatic liquidation mechanisms activate. The exchange forcibly closes positions to recover borrowed funds before losses exceed available collateral.

Stage 4: The Feedback Loop Ignites

Here's where cascades become catastrophic. Forced liquidations dump assets into the market at any available price. In low-liquidity conditions (especially during off-hours or volatile periods when market makers pull back), these sales push prices down further. This decline triggers additional margin calls across other overleveraged positions.

Stage 5: The Avalanche

The cycle accelerates. Each wave of liquidations depresses prices further, triggering the next wave. Stop-loss orders cluster around psychological price levels (like $100,000 for Bitcoin), creating "liquidation zones" where selling pressure intensifies exponentially. What starts as a 5% dip can cascade into 15-20%+ crashes in hours.

Critical Amplification Factors

High Open Interest: When aggregate leveraged positions reach extreme levels (like the $187 billion in open interest before the October crash), the market becomes a powder keg awaiting ignition.

Liquidity Vacuums: Weekend trading, Asian session hours, or periods following major moves see reduced market depth. A $1 million sell order that barely moves prices during peak liquidity can cause a 5% flash crash at 3 AM on Sunday.

Collateral Mispricing: Wrapped assets and less-liquid tokens can trade at severe discounts during cascades. In October, some wrapped staked ETH hit an 89% discount from fair value, triggering premature liquidations even for properly collateralized positions.

Exchange Bottlenecks: Centralized exchanges process liquidations sequentially. Binance handles roughly one per second at peak stress. This creates delays that allow positions to slip deeper underwater, ultimately increasing total market losses.

October 2025: Anatomy of the Largest Crypto Liquidation Event Ever

The "Tariff Nuke" of October 10-11, 2025, rewrote the record books for crypto volatility and liquidation scale. Here's the complete timeline and impact analysis.

The Catalyst: Geopolitical Shockwave

Late Friday, October 10th, President Donald Trump announced sweeping economic measures: 100% tariffs on Chinese imports paired with aggressive software export controls. This geopolitical bombshell triggered immediate risk-off positioning across global markets.

Crypto, trading 24/7 while traditional markets were closed for the weekend, became the primary outlet for panic selling. Bitcoin bore the brunt, plummeting from $122,000 to below $102,000 in a single hour. That 13% hourly decline became the steepest since March 2020's COVID crash.

The Cascade Unfolds: Market-by-Market Breakdown

Major Assets Devastation

- Bitcoin: $122K to $102K (16.4% intraday low)

- Ethereum: $4,400 to $3,700 (15.9%)

- Solana: Down 40% to near-term lows

- Avalanche: Down 70% from recent peaks

- Altcoins broadly: 30-60% drawdowns across the top 100

Exchange-Specific Carnage

Hyperliquid: The Epicenter

This perpetual DEX saw $1.23 billion in liquidations. Over 1,000 wallets were completely zeroed out, while 6,300 accounts went negative. Notably, 205 traders each lost over $1 million, including crypto influencer Machi Big Brother who shed $14 million in minutes.

Binance, Bybit, OKX: Mass Liquidations

The major CEXs processed the bulk of the $16.8 billion in long liquidations (positions betting on price increases). Processing bottlenecks during peak volatility meant some traders' positions liquidated at prices 5-10% worse than fair value.

DeFi's Resilient Performance

Aave auto-liquidated $180 million in collateral with zero bad debt, a stark contrast to CEX chaos. Kamino Lend handled $20 million in liquidations seamlessly through distributed liquidator networks. This performance gap highlighted DeFi's architectural advantages during extreme stress.

The Stablecoin Subplot: Ethena's USDe Panic

Perhaps the most alarming secondary effect was Ethena's USDe stablecoin depegging to $0.65, a 35% discount to its $1 peg. Despite the protocol remaining fully solvent with adequate backing, panic selling in illiquid markets created the appearance of catastrophic failure.

This triggered additional forced selling as USDe holders scrambled for exits, and exchanges marked down USDe collateral values, precipitating more liquidations. The depeg reversed within 36 hours as arbitrageurs stepped in, but not before amplifying the cascade's psychological impact.

The Human and Capital Toll

Scale metrics that define the event:

- Total liquidations: $19-20 billion confirmed, potentially $30B+ including underreported off-book positions

- Traders liquidated: 1.6-1.7 million accounts affected

- Complete wipeouts: Thousands of accounts reduced to zero

- Largest single liquidation: $45 million ETH long position vaporized in one candle

- Speed: $1.5 billion liquidated in the first hour alone

Market structure impact:

Open interest collapsed from $187 billion to $152 billion, a $35 billion reduction in leveraged exposure. Funding rates (the cost of holding leveraged positions) reset from highly positive (indicating overheated long speculation) to neutral, removing a key headwind for price recovery.

Historical Context: How October 2025 Compares to Past Flash Crashes

To appreciate October's unprecedented scale, consider crypto's history of violent liquidation events.

The Mt. Gox Era: Crypto's Wild West (2011)

On June 19, 2011, the then-dominant Mt. Gox exchange (handling 70% of Bitcoin trading volume) suffered a catastrophic hack. Bitcoin crashed from $17 to $0.01 on the exchange, a 99.94% flash crash.

While this represents the most extreme percentage drop ever recorded, the absolute capital destroyed was minimal given Bitcoin's tiny market cap. Total losses approximated $10 million, pocket change compared to modern events.

China's Regulatory Hammers (2013, 2021)

December 2013: China's central bank banned financial institutions from Bitcoin transactions. BTC halved from $1,150 to $500 in days, with $200 million in early futures liquidations. The nascent leverage markets couldn't absorb the shock.

May 2021: Renewed Chinese mining bans crashed Bitcoin 53% from $43,000 to $30,000, liquidating over $10 billion in 48 hours (the largest event until 2025). Altcoins shed 60-90% as leverage cascaded through the ecosystem.

Black Thursday: Crypto Meets COVID (March 2020)

March 12-13, 2020, saw Bitcoin crater 50% from $7,900 to $3,850 as COVID-19 panic engulfed global markets. The crypto selloff wiped out $1.1 billion in leveraged positions (then a record) and halved the total crypto market cap to $160 billion. BitMEX and similar platforms buckled under liquidation volume, with some experiencing multi-hour processing delays.

Notably, this crash marked crypto's correlation peak with traditional finance, moving in lockstep with equity markets for the first time. It also established the precedent that macro risk-off events could trigger crypto liquidation cascades independent of industry-specific news.

The 2022 Implosion Cascade: FTX and Luna/UST

Two 2022 events expanded the liquidation cascade playbook beyond simple leverage:

May 2022 - Terra/Luna Death Spiral: The algorithmic stablecoin UST depegged from $1 to $0.30, triggering a self-reinforcing collapse. LUNA plummeted 99.99% from $80 to near-zero in days. The Anchor Protocol liquidated over $2 billion in positions, with ecosystem-wide destruction topping $40 billion. This introduced "protocol-level cascades" where algorithmic mechanisms themselves became the trigger.

November 2022 - FTX Contagion: FTX's fraud-driven collapse sent Bitcoin from $21,000 to $15,500 (down 25%) with $1.6 billion in direct liquidations. Sister firm Alameda Research's forced asset sales amplified the cascade, contributing to broader $8+ billion in derivatives liquidations. This event proved that centralized platform failures could cascade through supposedly decentralized markets.

The Comparison: October 2025's Historic Position

October 2025's $19-20 billion liquidation dwarfs all predecessors by absolute capital destroyed. It exceeds the May 2021 China ban ($10B) by 90% and nearly doubles the cumulative liquidations of both major 2022 events combined.

What made October unique:

- Leverage saturation: Open interest had reached all-time highs of $187 billion

- Geopolitical trigger: Unlike internal crypto events, this was an external macro shock

- Processing efficiency paradox: Despite market maturation, centralized exchanges still bottlenecked

- DeFi vindication: On-chain protocols handled stress flawlessly while CEXs struggled

- Rapid recovery trajectory: BTC rebounded 11% within 72 hours, showing improved market resilience

The scale reflects both crypto's massively expanded market cap ($3+ trillion at pre-crash peak) and the proliferation of high-leverage perpetual futures products that didn't exist in earlier eras.

Why This Crash Actually Benefits the Market: The Post-Liquidation Opportunity

Contrarian as it sounds, massive liquidation cascades historically precede crypto's strongest bull runs. October 2025 follows this pattern while offering unique tailwinds.

The "Leverage Cleanse" Effect

Removing weak hands: Over-leveraged speculators (those most likely to panic sell during downturns) have been forcibly ejected. The remaining market participants have stronger conviction and healthier balance sheets.

Funding rate reset: Before the crash, perpetual futures funding rates (fees paid by longs to shorts) were extremely positive, indicating overleveraged bullish positioning. Post-crash, rates normalized, removing the structural headwind of over-positioning.

Open interest decline: The $35 billion reduction in open interest means less future liquidation risk. Markets can now move on organic supply-demand dynamics rather than cascade-driven volatility.

Volatility compression: Historically, 70% of major liquidation events precede 30-90 day volatility compression periods, which typically resolve upward as fear subsides and buyers return.

Early Recovery Signals Confirm the Pattern

By October 13, just three days post-crash:

- Bitcoin recovered to $113,600 (up 11.4% from $102K low)

- Ethereum bounced to $4,100 (up 10.8% from $3,700 low)

- Bitcoin ETFs recorded $2.7 billion in inflows, showing institutional buyers viewing the dip as opportunity

- Altcoins like BNB, ZEC, and MNT approached or exceeded pre-crash highs

On-chain metrics turned decidedly bullish:

- Solana saw $1 billion in fresh stablecoin deposits

- Arbitrum recorded $100 million in net bridge inflows

- Whale accumulation patterns emerged across major assets

- Exchange outflows increased (coins moving to cold storage, reducing sell pressure)

DeFi Proved Its Product-Market Fit

The crash became an inadvertent stress test that DeFi passed with flying colors:

Zero bad debt: Protocols like Aave, Kamino Lend, and Compound liquidated hundreds of millions in collateral without incurring losses. Distributed liquidator networks functioned perfectly even during peak volatility.

Transparency advantage: Every liquidation occurred on-chain with full visibility. No hidden counterparty risks, no mysterious "technical difficulties" halting withdrawals. Just transparent, automated risk management.

Comparison to 2008: Traditional finance's opacity enabled the subprime cascade. Crypto's transparency and automation prevent similar buildups of hidden systemic risk. As one analyst noted, "We saw the stress test that TradFi failed in 2008, but DeFi passed with honors."

Institutional validation: The flawless performance attracted renewed attention from traditional finance observers seeking crisis-resistant financial infrastructure. Post-crash, decentralized lending protocols saw TVL (total value locked) increase by $3 billion combined.

Macro Tailwinds Align for Q4 Rally

Rate cut cycle: Central banks pivoting to easing monetary policy typically fuels risk asset appreciation. Crypto benefits disproportionately.

Seasonal patterns: Q4 historically delivers crypto's strongest quarterly performance, with average gains of 40-60% for Bitcoin since 2015.

Halving echo: Bitcoin's April 2024 halving continues rippling through supply dynamics, with reduced miner selling pressure accumulating over time.

Institutional infrastructure: Spot Bitcoin and Ethereum ETFs now provide regulated entry points for billions in traditional capital. Post-crash inflows suggest institutions view volatility as buying opportunity rather than exit signal.

The Psychology of Market Resets

Fear Index readings of 38 (post-crash) historically correlate with 60-70% probability of positive returns over subsequent 30-60 day periods. When retail capitulates, smart money accumulates.

The October crash flushed out:

- Tourists seeking quick flips with maximum leverage

- Fair-weather investors lacking conviction

- Algorithm-driven momentum traders programmed to exit on volatility spikes

Remaining are:

- Long-term holders accumulating through volatility

- Institutional buyers averaging in at improved valuations

- Builders and community members focused on fundamental development

- Experienced traders who recognize liquidation cascades as opportunity

This composition shift historically precedes sustained upward momentum as selling pressure exhausts while buying accumulates.

Web3 Innovation: The Crash Validated Decentralization's Promise

Beyond market dynamics, October 2025 demonstrated Web3's technological maturity and competitive advantages over traditional finance.

On-Chain Finance's Transparent Crisis Management

Real-time visibility: Every liquidation, every margin call, every oracle price update occurred on public blockchains. Market participants could monitor systemic risk in real-time rather than discovering hidden exposures months later (as with 2008's CDO crisis).

Automated precision: Smart contracts executed liquidations at precise thresholds without human intervention, emotion, or manipulation. No discretionary "this counterparty is too important to liquidate" decisions that plague traditional finance.

Distributed liquidator networks: Instead of single-point-of-failure liquidation engines, DeFi protocols use competitive liquidator ecosystems where anyone can run bots to close undercollateralized positions. This distributed approach processed liquidations 10-15x faster than centralized exchange bottlenecks.

Collateral diversity: Protocols supporting multiple collateral types (ETH, BTC, stablecoins, LSTs) proved more resilient than single-collateral systems. When one asset experienced extreme volatility, borrowers could rebalance collateral types to avoid liquidation.

Emerging Sectors Accelerating Adoption

The post-crash landscape sees capital rotating into high-utility Web3 verticals:

AI-Crypto Integration: Platforms leveraging AI for trading, risk management, and market making saw usage surge. ElsaAI and similar AI agent projects attracted attention for using machine learning to predict liquidation cascades and optimize position management.

DePIN (Decentralized Physical Infrastructure): Projects building real-world infrastructure on blockchain rails continued development unaffected by market volatility, demonstrating crypto's expanding utility beyond pure speculation.

Prediction Markets: Platforms like Limitless crossed $100 million in trading volume during the crash as users hedged or speculated on recovery timing. This showcased prediction markets as functional hedging tools.

Cross-Chain Infrastructure: Bridge protocols and layer-2 solutions processed billions in value transfers during the chaos, with Arbitrum alone seeing $100 million net inflows as users sought lower-fee trading environments.

Restaking and Liquid Staking: Despite market turmoil, staking yields remained attractive. Protocols offering composable staking yields (using staked assets as collateral) saw continued growth, with Lido and similar platforms adding over $500 million in deposits post-crash.

The 2008 Comparison: Why This Time Is Different

The 2008 financial crisis stemmed from:

- Opaque off-balance-sheet derivatives

- Impossible-to-value mortgage-backed securities

- Counterparty risk webs where no single institution understood total exposure

- Rating agencies failing to identify risks

- Bailouts socializing losses

Crypto's October cascade, while violent, featured:

- Transparent on-chain exposures viewable by anyone

- Real-time risk monitoring via tools like DeFiLlama and CoinGlass

- Automated, rules-based liquidations with no discretionary bailouts

- Losses absorbed by risk-takers rather than taxpayers

- Rapid self-healing without government intervention

The philosophical difference: Traditional finance's complexity enabled risk-hiding and catastrophic failure. Crypto's transparency creates accountability and faster recovery.

In 2008, we didn't know who was screwed until the banking system and banks began failing. Just recently, we witnessed real-time liquidations, and markets began to heal within days, not months or years.

This transparency advantage is attracting traditional institutions seeking financial infrastructure resilient to the next global crisis.

Strategic Marketing Opportunities in the Post-Crash Environment

For crypto projects, brands, and marketing teams, the post-liquidation landscape offers unprecedented opportunities if approached strategically.

Why Now Is Prime Time for Growth Marketing

Clean slate positioning: With leverage purged and weak hands shaken out, projects can capture attention from a more sophisticated, committed audience. Marketing messages reach investors actually evaluating fundamentals rather than chasing leverage-fueled pumps.

Attention arbitrage: While competitors pause marketing during volatility, aggressive brands capture disproportionate mindshare. Historical data shows projects that maintained or increased marketing spend during drawdowns achieved 3-5x better brand recall in subsequent quarters.

Narrative reset: The crash created a natural before/after storyline. Projects can position themselves as "battle-tested" or "built for volatility," powerful narratives that resonate with shell-shocked traders seeking quality.

Reduced noise: With speculative shitcoins washed out and casino gambling subdued, substantive projects with real utility can cut through the noise more effectively.

Influencer and KOL Marketing: Amplifying the Recovery Narrative

The post-crash playbook: Crypto influencers and key opinion leaders (KOLs) are perfectly positioned to shape recovery narratives and drive renewed interest.

Educational content opportunities: Audiences crave understanding of what happened and how to protect themselves next time. KOLs providing valuable education (leveraging explained, risk management strategies, DeFi vs CEX comparisons) build trust that converts to long-term community loyalty.

Story-driven campaigns: The crash created countless personal stories, from traders who survived by using proper risk management to projects that helped users navigate the chaos. KOL campaigns and AMAs highlighting these narratives humanize brands while demonstrating value.

Sector rotation promotion: As capital moves from high-leverage speculation into utility-focused sectors (DeFi yield, AI integration, infrastructure), KOLs can guide their audiences toward these opportunities. Projects partnering with thoughtful influencers can capture this rotating capital.

Community rebuilding: Many crypto communities feel shaken post-crash. KOL partnerships focusing on community support, education, and long-term vision help projects retain and expand their user bases during recovery.

Credibility through crisis: Influencers who called for caution pre-crash or provided calm guidance during the storm have enhanced credibility. Partnering with these voices lends projects authenticity that pure-hype KOLs can't match.

Targeting Strategies for Maximum Impact

If you're in Web3 for the long haul, your audience is definitely out there right now. The projects that gain reach through the noise after a massive mid-bull crash are going to soar when the dust settles.

Audience segmentation post-crash:

Survivors: Traders who weathered the storm are educated, risk-aware, and possess capital. Market to them with messages emphasizing:

- Advanced risk management tools

- Transparent collateralization

- Institutional-grade security

- Sustainable yield rather than degen returns

Sideliners: Cash-heavy observers who exited before or during the crash are prime targets. They're looking for re-entry signals. Appeal through:

- Dollar-cost averaging strategies

- "Accumulation zone" narratives backed by on-chain data

- Educational content reducing re-entry anxiety

- Projects with proven stability records

Newcomers: Paradoxically, crashes attract new attention as crypto hits mainstream news. These users need:

- 101-level educational content

- Clear value propositions beyond speculation

- Community onboarding that's welcoming to beginners

- Products emphasizing utility over trading

Channel optimization:

- Twitter/X: The primary platform for crypto discourse. Post-crash, focus on data-driven analysis, transparent communication, and community engagement across Crypto Twitter.

- Telegram: Community building and direct user support. Active, responsive Telegram communities retain users through volatility.

- Discord: Deeper engagement for committed community members. Host AMAs, workshops, and strategy sessions.

- YouTube: Long-form educational content performs exceptionally well post-crash as users seek understanding.

- Podcasts: Thought leadership and crisis analysis via podcast appearances builds authority with sophisticated investors.

Campaign Messaging That Resonates

What works post-liquidation:

Transparency over hype: "Here's exactly how our protocol handled $50M in liquidations with zero bad debt" beats "🚀🚀🚀 TO THE MOON."

Education over speculation: "Understanding collateralization ratios in DeFi lending" outperforms "10 coins that will 100x."

Community over cult: "Join our community building the future of decentralized finance" resonates more than "You're still early! Get rich quick!"

Fundamentals over vibes: Data-driven marketing highlighting TVL growth, active users, transaction volumes, and developer activity builds credibility with the post-crash audience.

Long-term vision over quick flips: "Building sustainable infrastructure for the next decade" attracts committed community members rather than mercenary speculators.

What to avoid:

- Dismissing or minimizing the crash's impact

- Over-promising returns or "guaranteed" safety

- Aggressive leverage marketing

- Comparisons to traditional finance that ignore crypto-specific risks

- Hype-driven language lacking substantive backing

Leveraging Data and Proof Points

Marketing with credibility:

Protocol performance metrics: If your platform handled the crash well, showcase it. "Processed $180M in liquidations with 99.99% uptime and zero bad debt" is powerful social proof.

Comparative analysis: Position against competitors. "While CEXs experienced 4-hour withdrawal delays, our DEX maintained sub-2-second swaps throughout peak volatility."

User testimonials: Real stories from users who benefited from your platform's stability, customer service, or features during the crash build authentic trust.

Third-party validation: Security audits, risk assessments from reputable firms, and analyst reports carry weight with cautious post-crash investors.

On-chain transparency: Link directly to blockchain data proving your claims. "Our treasury holdings are verifiable at [address]" demonstrates confidence and builds trust.

Deploy Your Post-Crash Marketing Campaign with Lever.io

The window for capitalizing on post-liquidation opportunities is limited. As markets stabilize and attention shifts, the projects that moved fastest and most strategically will capture disproportionate mindshare and market share.

Why Lever.io Is Built for This Moment

Lever.io specializes in crypto-native influencer marketing and growth campaigns designed for exactly these conditions. Our platform connects you with the KOLs and communities that matter while providing the data and tools to maximize ROI during market recovery.

What makes Lever different:

- Campaign Managers: Get campaigns off the ground with full transparency through the platform and 100% guidance and coordination from Lever Campaign Managers who do all the hard work for you.

- Verified KOL Network: Access pre-vetted influencers across Twitter, YouTube, and TikTok, from macro analysts discussing market structure to technical educators explaining DeFi mechanics. No more guessing which voices actually move markets.

- Rapid Deployment: Launch campaigns in days, not weeks. Our streamlined platform and ready-to-activate KOL partnerships mean you can capitalize on market conditions before they shift.

- Educational Content Creation: Our team helps craft messaging that educates rather than hypes, building the long-term trust that converts post-crash skeptics into committed community members.

- Crisis Communication Expertise: We've navigated every major crypto crash. Our team knows how to message during volatility, what narratives resonate, and how to position your project as a safe harbor rather than another risk.

- Multi-Channel Orchestration: Coordinate campaigns across Twitter, Telegram, Discord, YouTube, and podcasts simultaneously. Maximize reach while maintaining consistent messaging.

Start Your Campaign Today

The recovery is underway. Early movers will capture the attention, capital, and community that defines winners in the next bull phase.

Ready to deploy a campaign that converts?

Visit Lever.io today to:

- Consult with our crypto marketing specialists on post-crash strategy

- Access our network of 500+ verified KOLs and influencers

- Launch campaigns that build authority, community, and sustainable growth

- Turn market volatility into competitive advantage

JOIN LEVER: START YOUR CAMPAIGN TODAY

The Bottom Line: From Crisis to Opportunity

The October 2025 liquidation cascade rewrote record books with its $19 billion in forced selling and 1.7 million affected traders. Yet history and current data both suggest this "leverage reset" cleared the path for crypto's next major bull run.

DeFi proved its reliability under extreme stress. Web3 demonstrated advantages over opaque traditional finance. And the market showed its resilience with rapid recovery that's attracting fresh institutional capital.

For crypto projects and marketers, the opportunity is clear: The audience is engaged, educated, and ready to commit to quality projects that proved their value during volatility. The projects that deploy strategic, authentic marketing campaigns now (while competitors remain frozen) will emerge as the next cycle's leaders.

Recovery happens. The question becomes whether your project captures the momentum.

Build smarter. Market better. Deploy with Lever.io.