Why Crypto KOLs Won't Work for Free, And What It's Costing You to Keep Asking

The "rewards-only" deal is not a creative budget solution. It is a signal that your project is not serious, and experienced KOLs read it that way immediately.

There is a negotiation happening right now in hundreds of Telegram and Twitter DMs.

A founder, CMO, or marketing manager has drafted an outreach message offering a KOL a percentage of trading fees, an airdrop allocation, signup bonuses or some combination of all three.

The implicit ask: promote our project for free in exchange for upside if it works out.

The KOL will either ignore the message, decline politely, or accept it (the more expensive outcome), deliver something low-effort, and move on.

What they will not do is treat it like a serious professional engagement.

Because it isn't one.

The rewards-only model persists because it feels financially clever.

It looks like a way to preserve runway while still generating marketing activity. In practice, it drains runway through a mechanism most founders don't account for: time.

Weeks of back-and-forth negotiations that go nowhere, campaigns delivered at half-effort by creators who have no real stake in the outcome, and delayed traction that pushes product-market fit further out.

The "free" KOL deal is rarely free. It is usually expensive in the ways that are hardest to see on a spreadsheet.

This article is a hard look at:

- Why upfront compensation is the professional standard

- What the data says about how established KOLs actually structure deals

- Why a platform like Lever.io has emerged as the infrastructure that makes paid KOL partnerships work at scale without requiring either party to trust blindly

The Math on Why "Rewards-Only" & "Performance Based" Deals Doesn't Work

Let's start with the arithmetic that most reward-based pitches skip.

A common structure offers a KOL 50% of trading fees generated by their referral.

On most DEXs, base trading fees can run around 0.1%. For a KOL to earn $10,000 from that arrangement, their referral code needs to generate $20 million in trading volume attributable to their promotion .

That is not an early-stage number.

Then, token allocations carry different risks.

If your project is pre-launch, the KOL is holding illiquid inventory with no guaranteed exit.

If the token launches and underperforms, which statistically is the base case for most projects, their "payment" approaches zero.

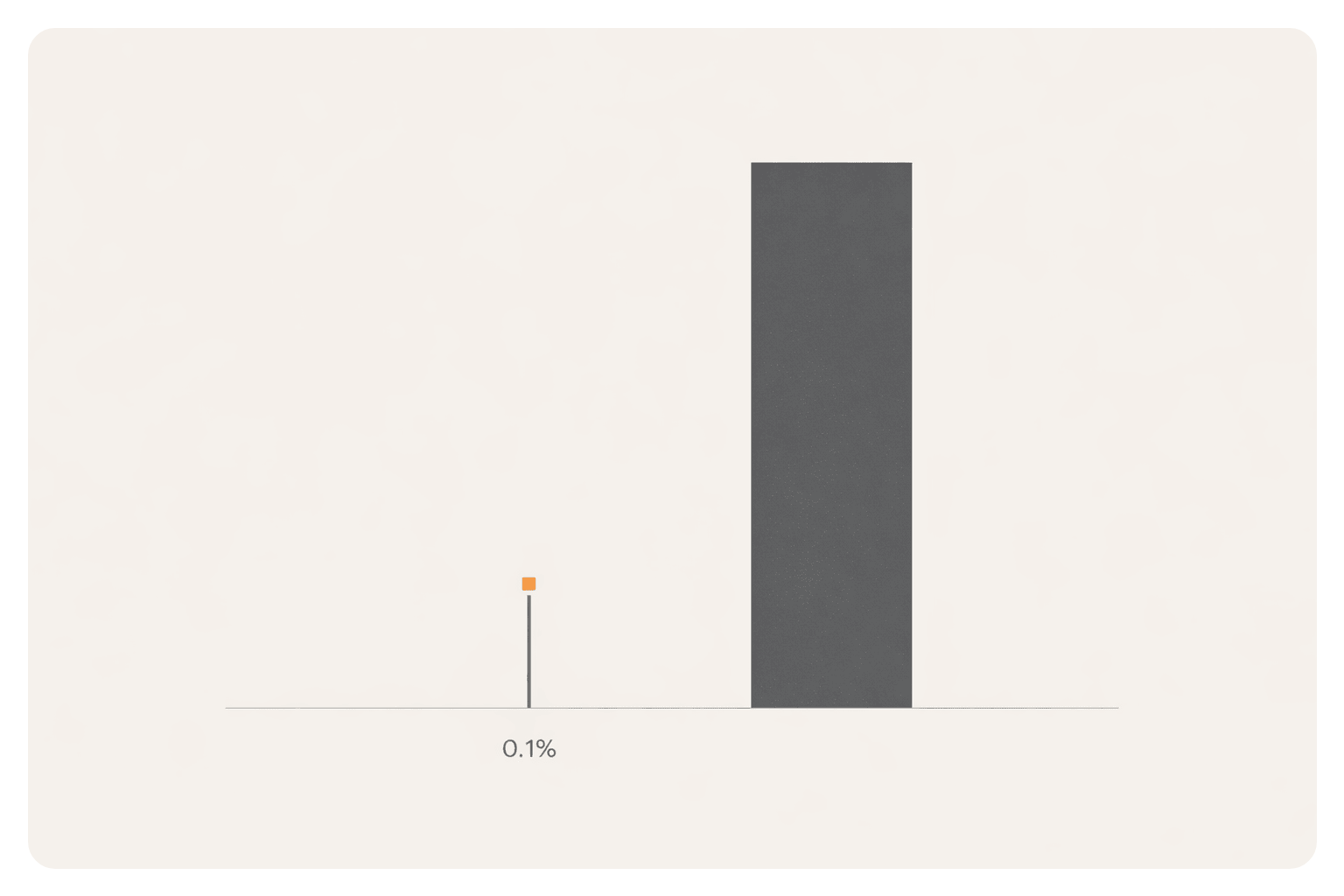

In an industry where 2024 and 2025 accounted for over 96% of all recorded token failures, accepting token compensation is a speculative bet, not a business arrangement.

The data reflects this clearly.

Performance-based or rewards-oriented structures accounted for roughly half of influencer payment arrangements in 2025, but this figure includes hybrid deals where cash was still the primary component and rewards were additive.

Pure rewards-only arrangements, meaning no upfront cash and only contingent upside, were concentrated almost entirely among low-tier or unestablished creators.

Established KOLs with track records and real audiences were operating on upfront flat fees, with rewards as an optional supplement.

That is the market.

Outreach that bypasses it isn't creative deal-making. It is a mismatch with how the professional layer of this industry operates.

What KOLs Are Actually Protecting When They Decline

Understanding why established KOLs won't accept rewards-only deals requires understanding what they are actually managing: a trust asset that took years to build and can be destroyed in a single bad promotion cycle.

Top KOLs in crypto are not primarily media channels:

- They are credibility intermediaries.

- Their audiences follow them because their signal-to-noise ratio has been reliable.

- When a KOL promotes something, the implicit message is that they have assessed it and believe it has merit.

- That signal is only valuable as long as it remains selective.

KOLs whose promotion histories showed a high rate of projects that subsequently failed saw measurable engagement decline across their channels:

- Audiences recalibrated.

- The trust asset depreciated.

- McDonald's applications get filled.

This is why established KOLs price their work at a level that reflects genuine selectivity.

Case in point: many of the KOLs who jumped into InfoFi campaigns managed to dilute their clout by participating in campaigns as bounty hunters rather than long-term partners.

Accepting a rewards-only deal for a project that hasn't demonstrated enough confidence in itself to pay upfront is not just financially unattractive.

It is a signal about project quality that a credible KOL will factor into their decision.

If the founders won't put money behind their own marketing, why should a KOL put their reputation behind it?

Crypto is not the beauty or fitness vertical, where gifting a physical product covers the creator's cost of content production.

In crypto, anything but stablecoins as payment represent a liability.

Asking a KOL to absorb that liability is asking them to take a position in your project without the rights and information a real backer or contributor would have.

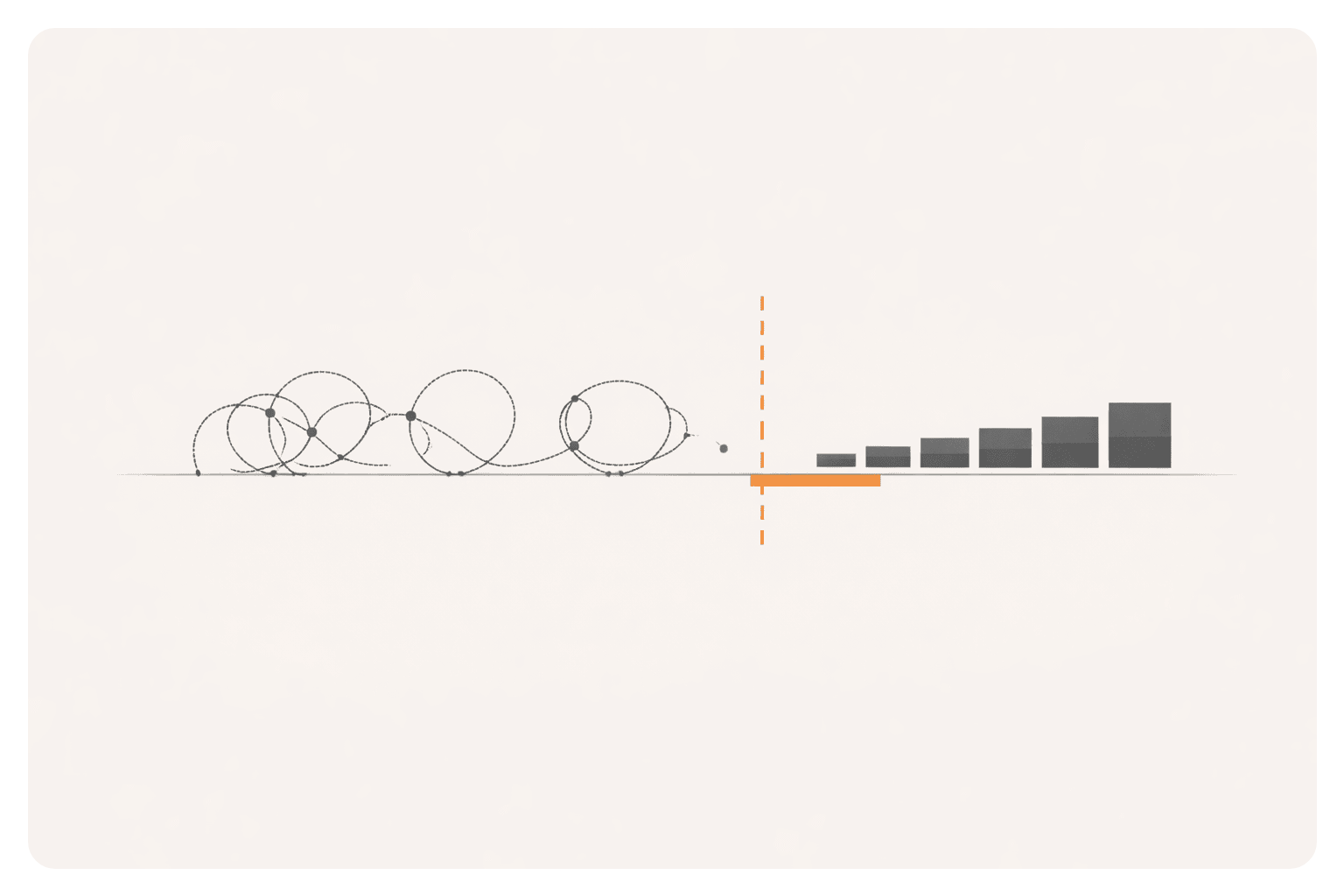

The Opportunity Cost Founders Are Not Measuring

The most consistent blind spot in crypto marketing budgets is the cost of failed outreach.

When a founder spends three weeks negotiating with KOLs over rewards-only arrangements, getting ignored, getting soft rejections, occasionally getting a low-effort post from a creator who accepted because they had nothing better, the accounting shows zero spend.

But the actual cost is substantial.

Three weeks of founder or CMO time at the stage where product-market fit decisions are being made is an enormous allocation.

The opportunity cost of those negotiations, measured in delayed partnerships, slower community growth, and pushed-out launch timelines, rarely shows up in post-mortems but consistently shows up in outcomes.

The mechanism is straightforward: paid, committed KOL relationships generate sustained, measurable activity:

- That activity builds social proof.

- Social proof accelerates market confidence.

- The upfront cost of the KOL relationships is a fraction of the success differential it enables.

The developer analogy holds here.

No engineering team would accept a proposal to build a protocol on spec: work now, get paid only if the project generates enough revenue.

The ask is understood as both professionally inappropriate and practically unworkable.

KOL marketing is structurally identical.

These are professionals with specialized skills, established audiences, and finite time.

The spec deal transfers all the risk to them while preserving all the optionality for the project.

That structure is not a partnership. It is exploitation framed as opportunity.

Why Lever Is the Infrastructure This Market Was Missing

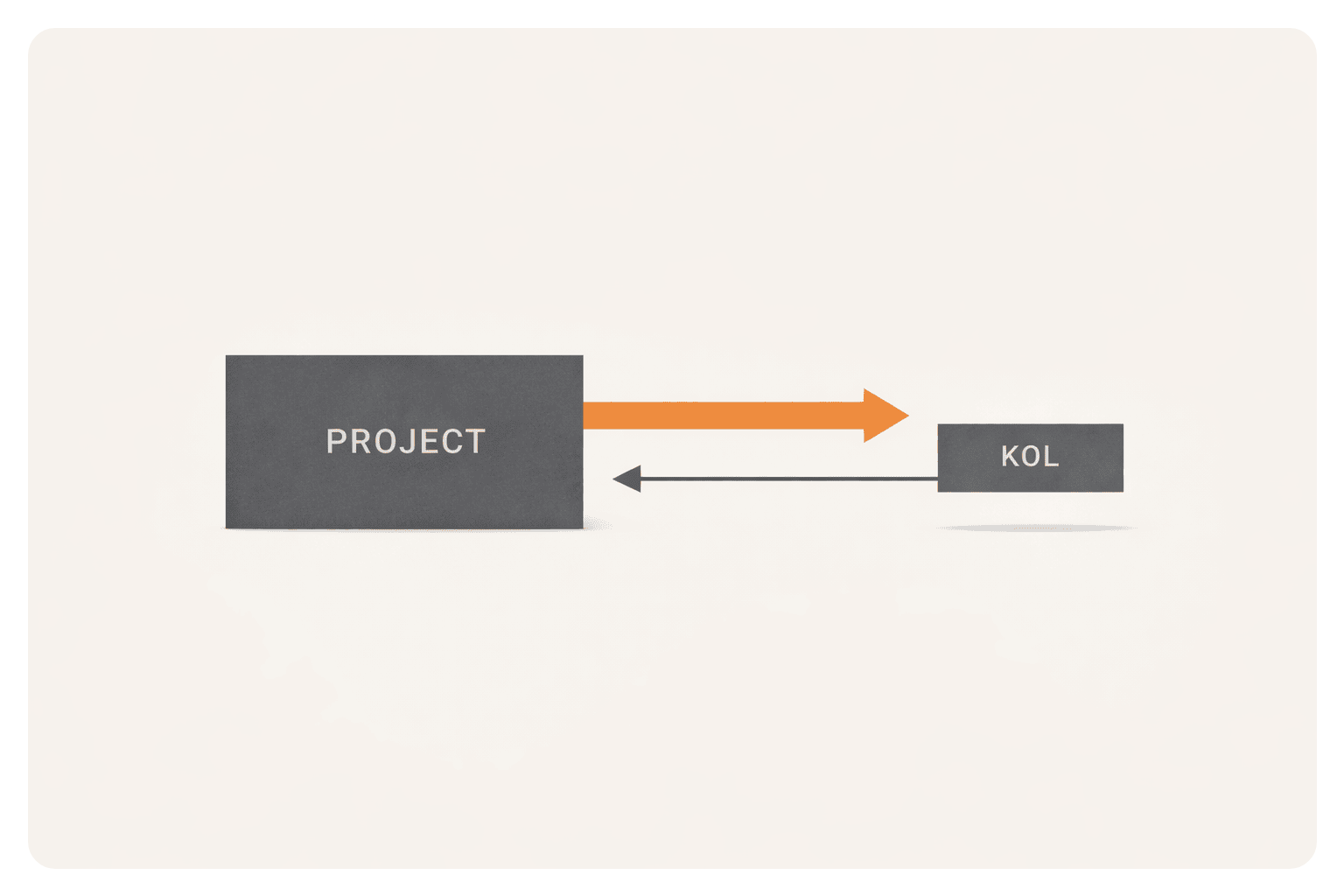

There is a well-documented history of trust issues on both sides of the KOL/project relationship:

- Projects have stiffed creators after receiving the content.

- KOLs have taken upfront payments and gone quiet.

In a pseudonymous, cross-jurisdictional industry with no reliable legal recourse, both failure modes are common enough that they shaped how deals got structured.

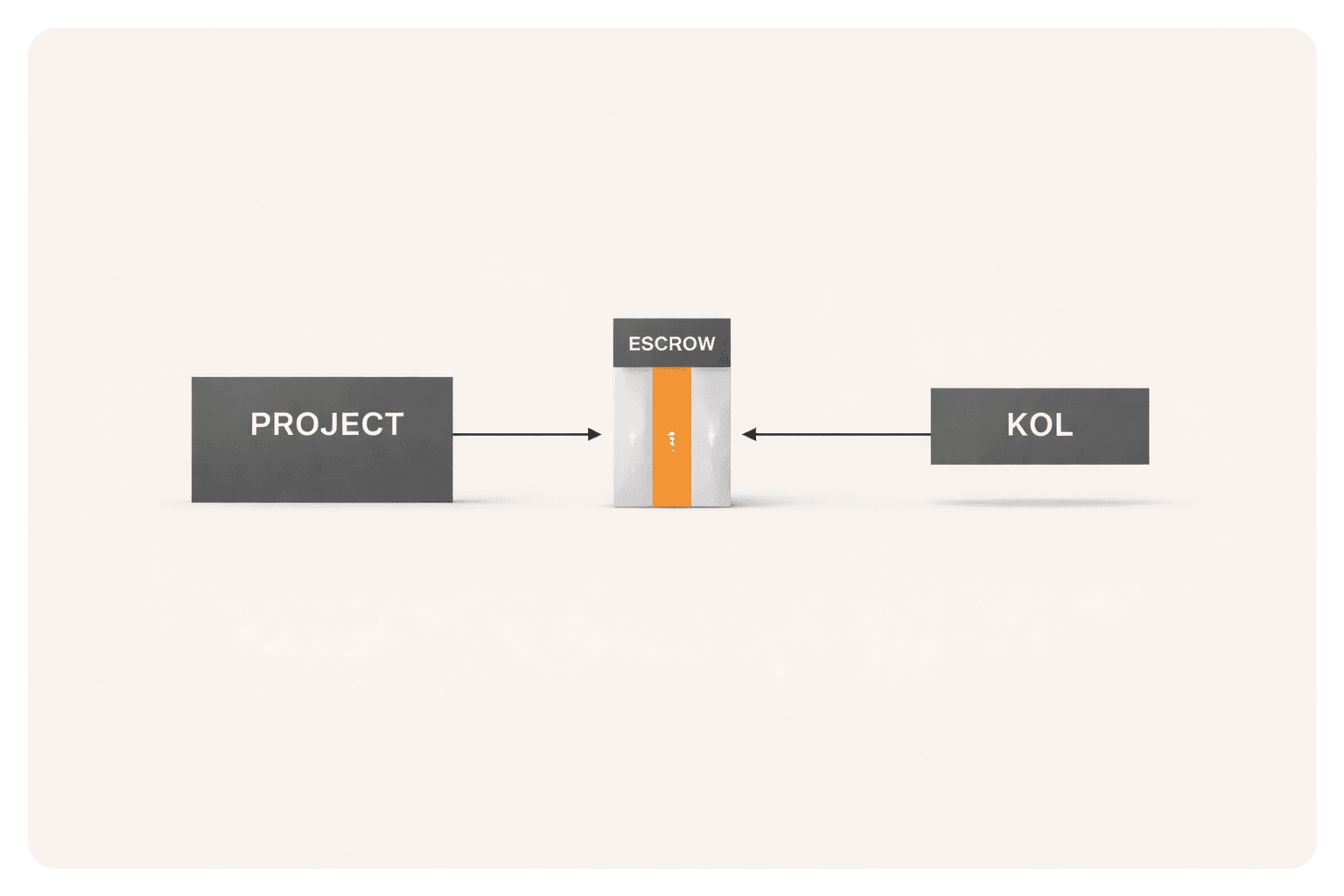

Lever exist to solve this problem:

- Funds are committed at the start of the engagement and released upon verified delivery of agreed deliverables.

- The project knows the funds won't be released if deliverables lack quality or are posted late.

- The KOL knows payment is guaranteed if they deliver.

The structural incentive for either party to fail disappears.

When a project approaches a KOL through Lever, the professional context is different from a cold DM with an offer.

The escrow layer signals that this is a structured, accountable engagement.

Lever's vetting layer, covering audience authenticity checks and engagement rate verification, means the KOL being proposed has already been filtered for the metrics that matter in crypto campaigns specifically.

And the performance tracking layer means both sides have shared, objective data on what the campaign actually delivered.

Traditional agency retainers solve a different problem and create new ones.

For example, a $30,000 monthly agency retainer allocates a fraction of that figure to actual KOL compensation.

Lever campaigns put your budget to work as efficiently as possible.

For founders managing runway carefully, the distinction is significant.

What a Properly Structured KOL Budget Actually Looks Like

For projects approaching serious marketing, industry benchmarks from 2025 suggest KOL budgets should represent 20% to 30% of total campaign budget, with the majority of that allocated to upfront, committed engagements rather than contingent arrangements.

A functional structure for a mid-sized launch looks something like this:

- Five to ten KOL relationships across tiers

- Micro and mid-tier voices representing the majority of the budget for conversion and community depth

- One or two macro-tier voices absorbing a smaller share for awareness and social proof

The goal of the budget allocation is not just to maximize impression volume.

It is to build brand awareness and drive users towards your project with measurable impact from KOL promotion to KPIs.

Marketing should be a repeatable process that can scale by following the data and allocating more resources to what works.

Even when a YouTube video from a mid-tier crypto KOL might not move the needle in a day, you're building a body of evergreen content from trusted voices that's there for future users and backers doing their due diligence in the future.

When your marketing output depends entirely on sub-standard KOLs willing to work for free, it shows.

The Bottom Line: Good KOLs Don't Work for Free

The market for credible KOL promotion in crypto is a paid market.

It has been a paid market since projects with real budgets started competing for the same voices.

The rewards-only pitch does not represent an untapped pricing arbitrage.

It represents a filter that established KOLs use to identify projects that are not ready to be taken seriously.

Platforms like Lever exist specifically to connect serious projects and trusted KOLs without requiring agency-level overhead or blind trust between parties who have never worked together.

If your current approach involves significant time spent negotiating compensation structures that shift all the risk to the creator, that time is your runway.

The conversation worth having is not how to get KOL marketing for free.

It is how to deploy a paid KOL budget in a way that generates measurable returns and builds the kind of professional relationships that compound across multiple campaigns rather than starting from zero every time.

That is the infrastructure Lever was built to provide.

Contact us if you're ready to start serious KOL campaigns.