What are Prediction Markets: A Web3 Marketing Perspective

This article covers how prediction markets work, their key components, and their possible business applications.

Prediction markets allow individuals to trade contracts based on future events. These platforms use collective insights to predict event probabilities, and they're shaking up the way people look at polling for the USA the election cycle in 2024, amongst other upcoming events in the world.

This article covers how prediction markets work, their key components, and their possible business applications. It's becoming increasingly evident that prediction markets have become a stellar use case for Web3 applications, and their evolution and adoption is becoming hard to ignore.

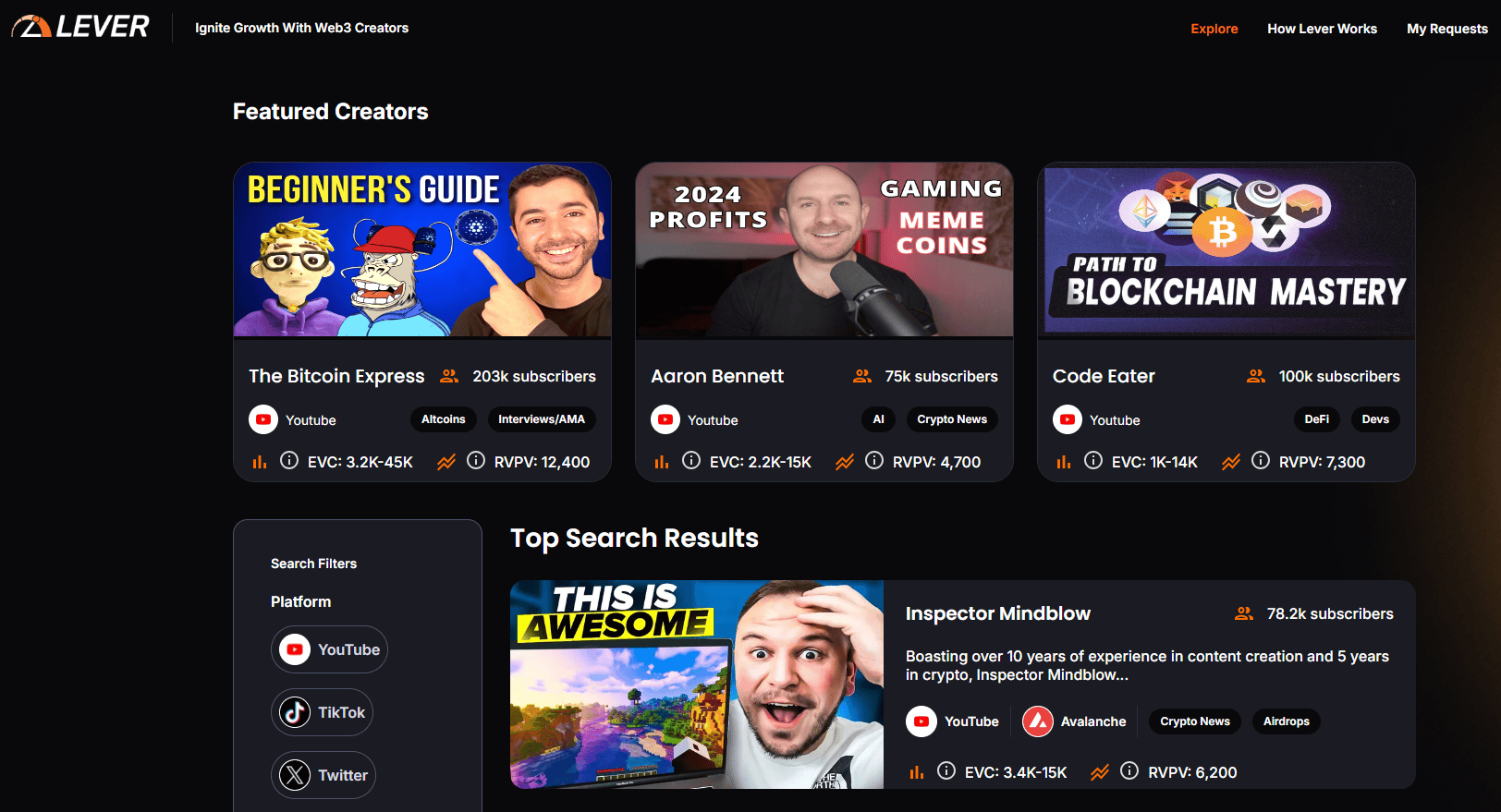

Working to help promote Web3 startups and cutting edge ideas in crypto, Lever.io supports the growth of each new Web3 sector with an innovative KOL marketplace. If you're building the future of Web3 and crypto, Lever.io is hear to help you get the word out. Sign up today.

Key Takeaways

- Prediction markets are trading platforms that allow individuals to buy and sell contracts based on the outcomes of future events, aggregating collective beliefs to forecast probabilities.

- They differ from traditional financial markets by focusing specifically on event outcomes rather than broader economic trends, allowing for more precise predictions.

- Prediction markets have significant applications in business for forecasting, enhancing decision-making, and managing risks related to uncertain future events.

Understanding Prediction Markets

Prediction markets are trading platforms where individuals buy and sell contracts based on the outcomes of future events. These markets are designed to elicit and aggregate beliefs about unknown future outcomes, effectively harnessing the wisdom of the crowd.

Market prices in prediction markets represent the collective estimated probabilities of these events, providing a real-time barometer of public opinion. Participants can express their viewpoints in monetary terms, making these markets not only a platform for speculation but also powerful tools for forecasting.

Typically, prediction markets operate through binary options, where contracts represent two possible outcomes. These markets attract traders because of their simplicity and the clear connection between predictions and payouts.

Participants can engage in a wide range of topics, from economic trends to pop culture phenomena, making prediction markets both versatile and accessible.

Key Components of Prediction Markets

The key components of prediction markets include market prices, traders, and the types of contracts available. Market prices are influenced by the willingness of participants to risk money based on their predictions, reflecting the perceived probabilities of future events.

Traders engage by buying and selling contracts, speculating on the likelihood of various outcomes. The number of outstanding shares helps infer the probability of different outcomes, providing insights into the collective judgment of participants.

Anyone looking to participate in prediction markets should understand the different types of contracts and trading mechanisms. These mechanisms can include continuous double auctions or automated market makers, which facilitate the buying and selling process.

Aggregating diverse perspectives in prediction markets enhances the reliability of forecasts, making them valuable tools for decision-making. The concept holds that actors in the market will provide better predictions than keyboard warriors on Crypto Twitter when push comes to shove.

How Prediction Markets Differ from Traditional Financial Markets

Prediction markets and traditional financial markets differ fundamentally in their focus and risk profile. Prediction markets zero in on specific event outcomes, such as election results or product launches, rather than broader economic trends or corporate health.

This concentrated focus allows for more precise forecasting of particular events, leveraging the collective intelligence of participants to predict outcomes.

In traditional financial markets, risks are diverse and tied to various factors like market conditions and corporate performance. Conversely, risks in prediction markets are directly linked to the occurrence of defined events, making them more targeted and specific. This distinction highlights the unique value proposition of prediction markets as tools for forecasting and decision-making.

The Mechanics of Prediction Markets

Understanding the mechanics of prediction markets is crucial for grasping how they function as platforms for forecasting future events. These markets operate similarly to traditional trading platforms, where individuals speculate on the outcomes of uncertain events.

The collective opinions of participants influence market prices, providing a dynamic and real-time measure of event probabilities.

Trading and Market Prices

Trading in prediction markets involves buying and selling contracts based on the predicted outcomes of events. Prices fluctuate according to trader interactions, reflecting the consensus about the likelihood of these outcomes.

For instance, if a contract is priced at $0.60, it suggests a 60% probability of the event occurring, such as a specific movie winning an Oscar. These market prices change as views on the likelihood of outcomes shift, making them a real-time indicator of public opinion.

Participants can buy and sell shares in these contracts, with prices indicating the perceived probability of outcomes. The fluctuating prices of related contracts provide insights into the likelihood of specific events, allowing investors and traders to make informed decisions based on the collective intelligence of the stock market.

Determining Outcomes and Payouts

In prediction markets, outcomes and payouts are determined based on the final state of the event being predicted. Payouts are made to holders of shares in the winning outcome, based on the last trading price.

Typically, these markets use a binary structure, where payouts are either $0 or $1, depending on the outcome. This simplicity ensures transparency and encourages participation by providing clear incentives for accurate predictions.

The probabilities of each outcome are inferred from the number of outstanding shares and their trading prices. As shares are bought, the inferred probability of the event increases, providing a dynamic and evolving picture of public sentiment. Ultimately, the winning shares pay out $1, making the financial mechanics straightforward and predictable for all participants.

Applications of Prediction Markets in Business

Prediction markets have found significant applications in various business sectors, providing robust forecasts and enhancing strategic planning. Businesses use these markets to gain insights into uncertain future events, leveraging the collective intelligence of market participants.

From finance to healthcare and technology, prediction markets have demonstrated their versatility and effectiveness in forecasting outcomes and improving decision-making.

Forecasting Future Events

Businesses often utilize prediction markets to forecast outcomes related to elections, product launches, and market trends. For example, Google’s internal prediction market has generated precise forecasts related to significant events like COVID-19, demonstrating the power of prediction markets in providing accurate insights.

Gauging public sentiment and predicting the results of events like product launches or election outcomes help companies make more informed strategic decisions.

Prediction markets, like the Iowa Electronic Markets, have also proven their capability in political forecasting, often outperforming traditional polling methods during us elections. These markets can provide a real-time measure of public opinion, helping businesses and political analysts alike to anticipate outcomes with greater accuracy.

Enhancing Decision-Making

Prediction markets serve as a valuable tool for enhancing decision-making within organizations. By aggregating insights from a diverse group of participants, these markets provide data-driven inputs that support strategic decisions. For instance, companies can analyze data derived from prediction markets to understand the probabilities of different outcomes, enabling them to make more informed choices.

Google’s prediction market, where over 175,000 predictions were made by more than 10,000 employees, is a testament to how these markets can improve forecast accuracy and decision-making within a company. Incorporating collective knowledge enables businesses to develop strategies that align more closely with potential future scenarios.

Risk Management

Prediction markets also play a crucial role in risk management for businesses. Evaluating potential risks linked to uncertain future events allows companies to develop proactive strategies to mitigate these risks. Analyzing prediction market data allows businesses to identify and quantify risks, adjusting their plans accordingly to better manage uncertainties.

Prediction markets help businesses assess the probability of market disruptions or the success of new initiatives, providing valuable insights for risk management. This method of risk assessment enables companies to make more informed and resilient strategic decisions.

Case Studies of Successful Prediction Markets

Examining real-world case studies of successful prediction markets provides valuable insights into their practical applications and benefits. Companies like Google have implemented prediction markets to forecast the success of their products and initiatives, significantly improving decision-making within the organization.

Google’s Prediction Market

Google’s prediction market has been operational for eight quarters, consistently yielding accurate and decisive predictions. The outcomes of this market have enhanced Google’s strategic planning and forecasting capabilities, demonstrating the effectiveness of prediction markets in a corporate setting.

Studies have shown that real-money prediction markets, like Google’s, are more accurate for non-sports events compared to play-money markets. This accuracy underscores the value of financial stakes in driving more precise predictions.

Notable Examples of Public Prediction Markets

Beyond Google, other notable examples of successful prediction markets exist in the public domain. These platforms allow users to participate in a form of polling that puts their money where their mouth is.

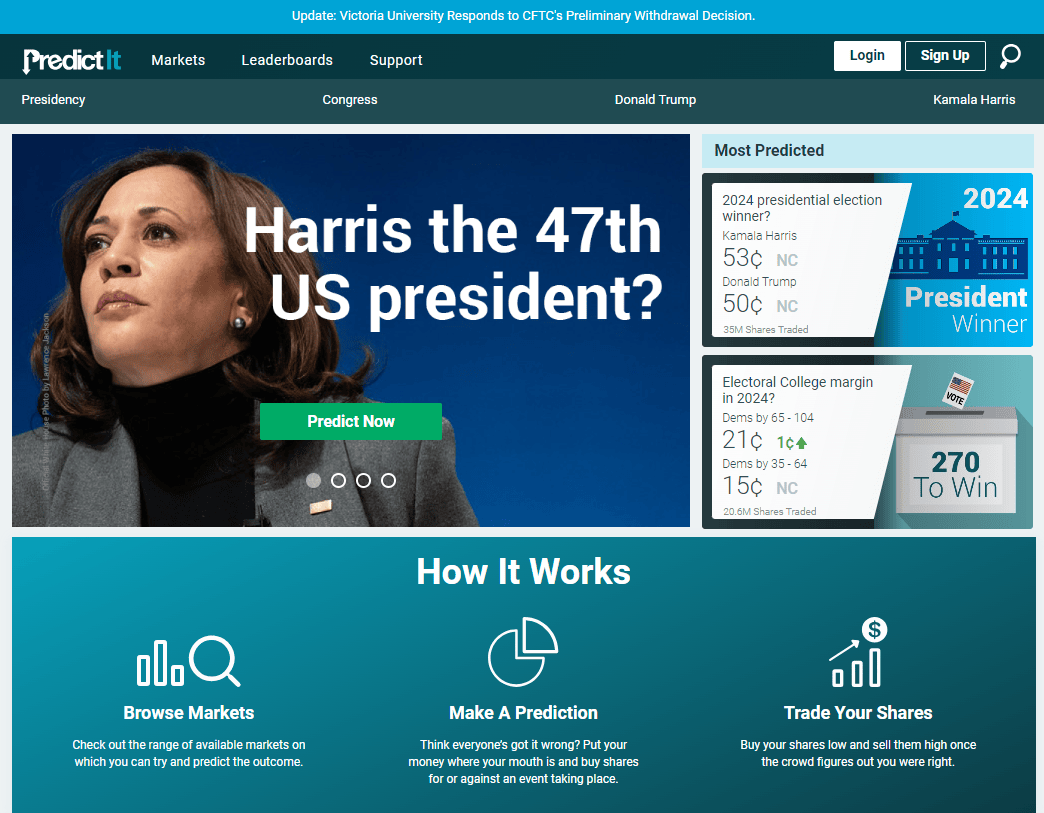

- PredictIt

PredictIt is a popular Web2 prediction market platform that allows users to trade shares on the outcomes of various political and financial events. Founded in 2014 by Victoria University of Wellington in New Zealand, PredictIt is designed primarily as an educational and research tool, although it also attracts a significant number of participants interested in forecasting political outcomes.

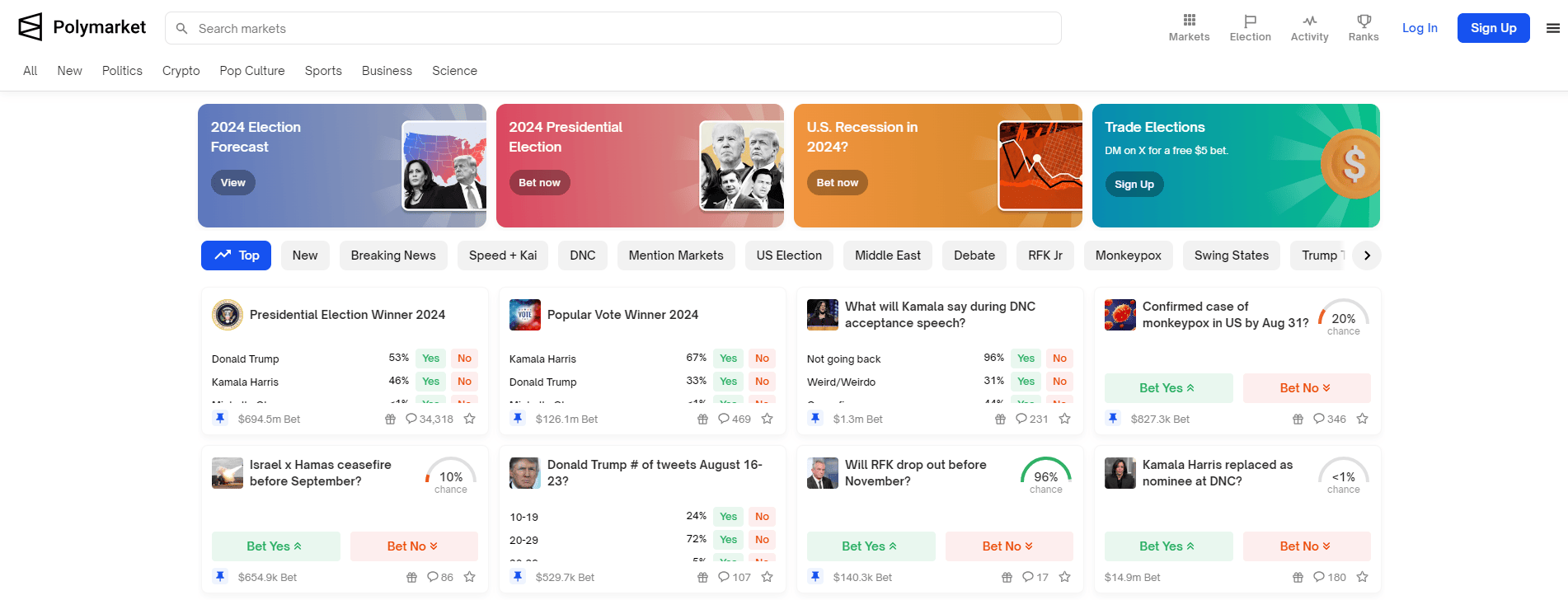

- Polymarket

Polymarket is a decentralized prediction market platform that allows users to trade on the outcomes of various events using cryptocurrency. It operates on the Polygon blockchain, providing a transparent, decentralized, and censorship-resistant platform for users to speculate on real-world events.

Polymarket has gained attention for its innovative approach to prediction markets, leveraging blockchain technology to create a more open and accessible system compared to traditional platforms. Some might call Polymarket a descendent of the now defunct Augur, the first prediction market build on Ethereum.

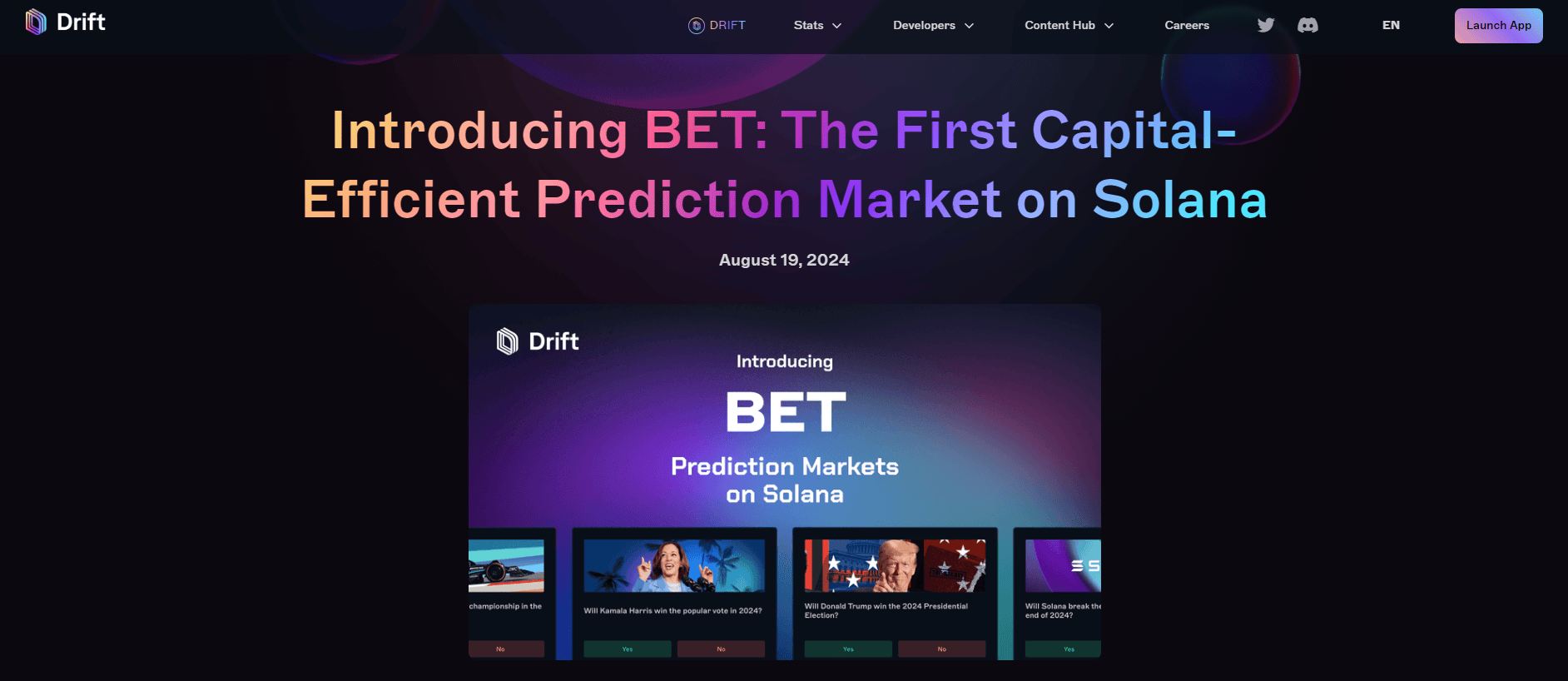

- Drift

Drift Protocol has recently launched BET, a prediction market platform on the Solana blockchain. BET allows users to trade on the outcomes of real-world events, starting with the 2024 U.S. Presidential Election.

Built on the foundation of Drift's decentralized exchange, the platform integrates DeFi features like cross-collateral trading and liquidity provision with multiple tokens. Since its launch, BET has attracted around $3 million in liquidity within a short period.

Participating in a Prediction Market

For those interested in participating in prediction markets, the process involves choosing a platform, understanding the types of contracts, and starting to trade. Various online platforms offer opportunities to engage in prediction markets, allowing participants to make bets based on their predictions.

Choosing a Platform

Selecting the right prediction market platform is crucial for successful participation. Traders must choose a market, decide whether to bet on ‘yes’ or ‘no’, set their price, and determine the number of contracts to purchase.

Being aware of the legal implications in different jurisdictions due to varying regulations is also important.

Participants can fund their accounts using various payment methods, depending on the specific platform. This flexibility ensures that participants can easily start trading and engaging in prediction markets.

Steps to Start Trading

To start trading in a prediction market, create an account on a chosen platform and fund it. With a funded account, traders can place bets on predicted outcomes by selecting contracts from the market.

This straightforward process ensures that anyone interested in prediction markets can easily get started and begin leveraging these powerful forecasting tools.

The Future of Prediction Markets

The future of prediction markets is promising, with technological advancements and evolving regulatory landscapes playing key roles. Innovations like blockchain technology are set to enhance the security and transparency of these markets, encouraging wider participation.

Technological Innovations

Blockchain technology can significantly improve the transparency and security of prediction markets. Decentralized prediction markets can operate without a central authority, making them more resistant to manipulation.

Smart contracts are crucial in these blockchain-based markets, automating transaction settlements and ensuring fair play.

Innovations in market design, such as combinatorial prediction markets, allow for more complex betting options, capturing more nuanced predictions. These advancements are set to revolutionize the way prediction markets operate and their effectiveness in forecasting.

Regulatory Landscape

The regulatory landscape for prediction markets is evolving, with current regulations often centered around gambling laws and financial trading regulations. As regulators scrutinize these markets to determine their classification, participants must stay informed about legal compliance to protect their investments.

Increased regulation could lead to more legitimacy for prediction markets, encouraging broader participation while potentially limiting market flexibility. As regulations evolve, prediction markets may need to adapt their operations, influencing their growth and development.

Are Web3 Prediction Markets Pushing Crypto Mainstream?

Prediction markets are emerging as a powerful tool in marketing Web3 to the masses by demonstrating the practical, real-world applications of decentralized technology. As Web3 continues to evolve, the challenge lies in making its complex concepts accessible and relevant to the general public. Prediction markets, with their straightforward yet impactful mechanisms, are playing a crucial role in bridging this gap.

Simplifying Complex Concepts

One of the primary ways prediction markets are aiding in marketing Web3 is by introducing newbies to concepts such as a crypto wallet, decentralized finance, and even DePIN.

At their core, prediction markets allow users to speculate on the outcomes of future events, offering a clear and relatable example of how Web3 technology can be utilized in everyday life.

By engaging with these markets, users can experience firsthand the benefits of blockchain technology, such as transparency, security, and decentralization, without needing deep technical knowledge. The value layer added by Web3 adds another dimension of "skin in the game" vs. social media polling.

Enhancing Public Engagement

Prediction markets are also enhancing public engagement with Web3 by turning abstract concepts into tangible experiences. For instance, when individuals participate in prediction markets related to current events, such as political elections or sports outcomes, they are directly interacting with Web3 technology.

This interaction demystifies the technology and fosters a deeper understanding and appreciation of its potential. As a result, prediction markets serve as an entry point for newcomers to explore other aspects of the Web3 ecosystem.

Showcasing the Power of Decentralization

The decentralized nature of prediction markets showcases one of Web3's most significant advantages: the ability to operate without a central authority. By removing intermediaries, these markets provide a more transparent and fair environment, which resonates with the growing public demand for greater control over their data and financial transactions. This demonstration of decentralization in action helps to build trust in Web3 technologies, making them more appealing to a broader audience.

Driving Adoption Through Real-World Use Cases

Prediction markets provide concrete use cases that illustrate the practical benefits of Web3. Whether it's predicting election outcomes, forecasting financial trends, or gauging public sentiment on various issues, these markets highlight the versatility and utility of decentralized platforms.

By driving home the message that Web3 is not just a theoretical concept but a set of tools with real-world applications, prediction markets are instrumental in driving wider adoption.

Spotlight Your Next Big Web3 Idea with Lever.io

Lever.io offers a streamlined solution for hiring influencers and KOLs, eliminating the need for lengthy negotiations. Lever.io provides access to top influencers at pre-negotiated rates, ensuring the lowest cost-per-service on the market.

Sign up for Lever.io today and see how you can supercharge your influencer marketing strategy. With the click of a button, you can spotlight your next big Web3 idea and leverage the power of influencers to reach your target audience effectively.