The $20k Statistical Minimum: Why Web3 User Acquisition in 2026 Has a Data Threshold

In an era of increasing competition for Web3 mindshare, here's the KOL marketing math founders and teams should understand.

The crypto market hasn't changed its core challenge. In 2026, customer acquisition remains expensive and competitive.

Web3 KOL marketing still relies on continuous maturation and data-driven approach.

What has changed is the minimum viable budget required to generate actionable data.

Our team at Lever still sees founding teams approach growth with $3k "testing budgets," hoping to identify a winning channel before committing serious capital.

The hard reality in 2026: These budgets don't buy tests. They buy expensive noise.

Unfortunately, the numbers tell a story most founders don't want to hear until they've already burned the money.

The Algorithm Reality: Why Small Budgets Always Pay More

Let's start by taking a look at the "big picture" for advertising and marketing outside of the crypto and Web3 bubble.

Modern ad platforms, the largest and least friendly to Web3 being Meta and Google, operate on deep-learning auction models that require substantial conversion data to function.

This isn't 2019, and you can't manually outmaneuver the algorithm anymore (although this is what we have to do in crypto).

The Learning Phase Reality:

- Meta requires approximately 50 optimization events per ad set per week to exit Learning Phase

- Google Smart Bidding typically needs 50+ conversions across 3 cycles for stable performance

- During Learning Phase, you're paying 2-4x higher effective CPAs while the algorithm figures out your customer

The Math for Crypto Projects:

Let's use our imaginations and pretend crypto advertising was allowed on the Google and the Facebook. If your Cost Per Verified User averages $150 in mixed Tier 1/2 markets:

- You need $7,500+ per ad set just to generate enough conversions to exit the Learning Phase

- With various onboarding frictions (40-60% KYC drop-off if you're a CEX in 2026), factor in another 1.5-2x buffer

- Real minimum: $15,000-$20,000 per channel to get clean signal

In the end, with a $5k total budget, you're not getting very far through the learning period.

You're paying premium prices for exploratory-phase performance, then stopping exactly when the data would start working for you—if you were launching campaigns on Google, but we can't.

The Partnership Trap: One Shot, Zero Safety Net

When paid ads feel prohibitively expensive, many normie teams pivot to KOL partnerships as a capital-efficient alternative, especially with multiple creator touchpoints outperforming one-offs.

However, for Web3 and crypto, KOL partnerships are pretty much the only option.

Current KOL Economics (Crypto-Native Influencers)

- Top-tier (500k+): $10k+ per deliverable

- Mid-tier (50k-200k followers): $4k-$7k per multi-platform bundled package

- Micro-influencers (10k-50k): $500-$2k for a wider range of services bundled across

The Small Budget Dilemma

Let's look at some examples of how you can deploy your funds towards a trial campaign, using creators of different tiers as examples.

If you allocate $10k to two mid-tier KOLs:

- Huge variance risk: If they can't catch the algo, or market sentiment shifts, your budget evaporates.

- No retargeting capacity: Maybe you've captured initial attention, but you have zero budget to nurture the rest of the acquisition funnel.

- No iteration: You can't test different messaging angles, and you can't pivot if the first placement underperforms.

If you allocate $10k to five micro-KOLs:

- Improved signal diversity: You collect performance data across different audience clusters, content styles, and posting times.

- Limited retargeting capacity: You may generate enough surface-level interest to seed retargeting pools, but not enough scale to run sustained or optimized follow-up campaigns.

- Still no meaningful iteration: While you gain anecdotal learnings, the budget remains too small to systematically test creative, messaging, or sequencing in a statistically defensible way.

This isn't a knock on KOL marketing.

It's our core expertise at Lever.

But KOL plays become yield-generating assets at scale, not lottery tickets. You need to budget for multi-touch sequences, retargeting, and optimization cycles over the course of your campaign.

The 2026 Reality: Benchmark Table

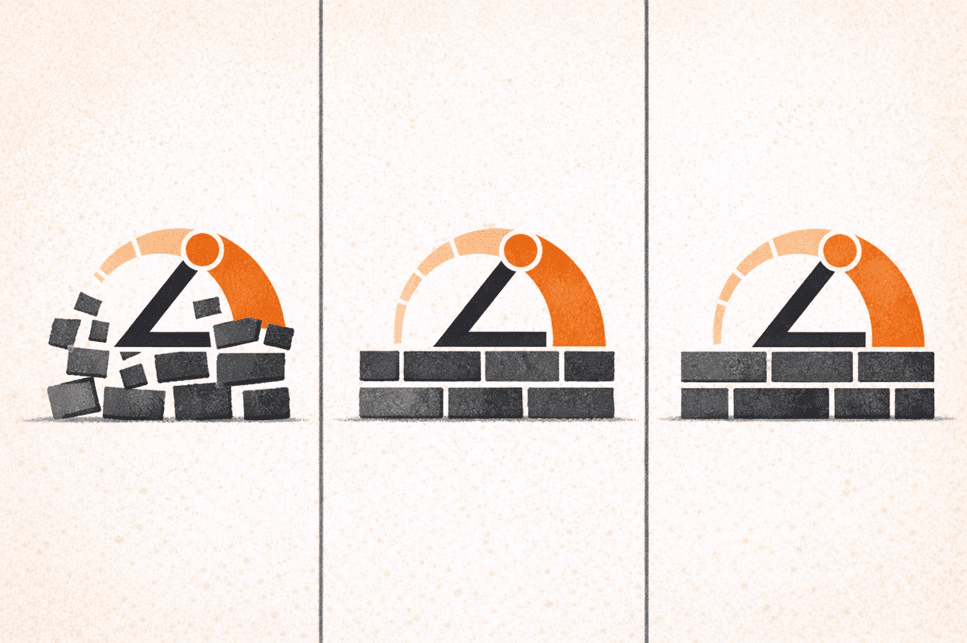

| Budget Range | Strategic Posture | Expected Verified Users* | Success Probability** | Reality Check |

|---|---|---|---|---|

| $3k-$10k | Exploratory | 15-60 | <15% | High-variance moonshot. No room to fix broken funnels, swap creative, or weather market volatility. Often burns without actionable insight. |

| $20k-$50k | Validation | 120-350 | ~55% | Strategic minimum. Enough to test multiple channels, gather data, retarget drop-offs, and identify repeatable acquisition models. |

| $100k+ | Scaling | 750-2,500+ | 85%+ | Full-funnel capabilities. Can "compete with noise," lower cost over time via sustained data accumulation, and weather most market swings. |

Small budgets have a small margin for error. If a single variable swings against you mid-campaign, there's no capital buffer to ride it out or pivot. The campaign may finish before making a huge breakthrough.

The Exchange Paradox: Why Do Revenue-Generating Platforms Underinvest?

Here's something we see constantly that defies logic:

Mid-tier exchanges often generate meaningful daily revenue from:

- Trading fees (0.1-0.6% per trade, scales with volume)

- Listing fees from new token launches

- Withdrawal and deposit fees

Yet their marketing teams receive mandates to "bootstrap" user acquisition with $3k budgets.

These amounts look like rounding errors against monthly operations spending.

Meanwhile, bootstrapped dApps consistently outperform on lean budgets by:

- Treating growth as a yield-generating asset, not a cost to minimize

- Using hyper-targeted micro-KOL seeding (5k-50k followers who ARE the community)

- Deploying referral mechanics and on-chain incentives that compound

- Focusing budget on high-engagement niche communities vs. broad awareness

The difference? dApps with far less revenue understand that underinvesting in acquisition is the expensive mistake.

They allocate intelligently at every stage.

In 2026, treating UA as discretionary rather than foundational is how you lose market position.

When Small Budgets CAN Work: The Strategic Exceptions

Of course, there are exceptions to the $20k threshold. There are scenarios where $5k-$10k can generate real value:

1. Warm Audience Activation

If you already have 500+ waitlist signups or engaged community members, spending $10k on conversion optimization and retargeting can work. You're not fighting the cold acquisition game. You're activating existing intent.

2. Geographic Arbitrage

Tier 2/3 markets (Southeast Asia, Latin America, parts of Eastern Europe) can deliver $30-$80 overall. If your product has strong product-market fit in these regions, smaller budgets with regional KOLs can yield results.

3. Pure Creative Testing (With Owned Traffic)

If you have organic traffic via content, partnerships, or community, using $5k-$10k to test messaging angles and creative variants makes sense. You're optimizing conversion.

4. Referral Loop Seeding

Allocating $10k to incentivize your first 50-100 power users to each refer 2-3 qualified friends can work IF your product is sticky, which probably means a rewards or points program that's hard to ignore.

The Pattern: Small budgets work when you're optimizing existing traction, not creating it from scratch.

What to Actually Do With a $10k Budget

If you genuinely only have $10k available right now, don't blow it on one top-tier KOL, hoping for a miracle. The probability of success is <15%. Instead:

Invest in Evergreen Content

Hire low to mid-tier creators on Lever with deals on long-term bundles. Build your organic engine with:

- Educational content that ranks in search and AI

- Explainer videos that establish thought leadership

- Community-building content shared on X/Discord

Syndicate Your Message Regularly

Hire Crypto Twitter KOLs who have built communities by not burning out their welcome with constant posting-for-bounties. They can:

- RT/QT your biggest announcement tweets

- Write threads explaining your project

- Share your evergreen content, bringing more eyes

Activate Your Community

Your making up for budget with elbow grease. Your team stays active in the community channels and promotes users to:

- Interact with and share KOL content

- Coordinate community-led pushes to lift the algo

- Create more organic buzz alongside hired KOLs

This creates lasting value that builds over time instead of blowing one-time campaign spend on a moonshot.

The Bottom Line: Growth Engineering Requires Minimum Viable Budget

User acquisition in 2026 is a statistical and engineering problem, not a creative or willpower challenge. It requires enough "fuel" (budget) to:

- Complete exploration mode

- Absorb market volatility

- Iterate on messaging, creative, and platform mix

- Retarget and nurture prospects

Below a statistical minimum, it's incredibly difficult to meet all of these requirements.

At Lever, we recommend a $20k+ floor not because we're trying to squeeze a nickel from a dime, but because we value your ROI as much as our ability to help your project succeed.

We've seen too many teams burn limited capital on structurally disadvantaged campaigns.

We've also seen too many teams waste their spend on agencies that over-promise and under-deliver.

Let's deploy KOL campaigns that actually work.

If you're ready to approach growth as engineering rather than guesswork, and you have committed marketing capital, we'd love to explore building KOL campaigns together.

Ready to Stop Guessing and Start Scaling?

We work with projects that understand growth requires investment, not just experimentation.

Book Your Onboarding Call (15-30 min)

Lever.io specializes in KOL marketing for Web3 projects. Our team has participated in campaigns for 50+ crypto projects, DeFi protocols, and other blockchain platforms over multiple cycles.