Meme Coin Trading: Short History of Web3's Biggest Attention Magnet

This article from Lever.io, will look at the staying power of memes in Web3 by examining a brief history of meme coins over a decade and the Web3 infrastructure that supports their trading on the market.

Web3 has emerged as one of the most powerful disruptors in tech. It can be argued that Web3 rivals only AI for the capital-I Internet's biggest step-change since the introduction of social media.

That being said, the mindshare on Crypto Twitter for Web3 decentralized applications (dApps) like decentralized finance (DeFi) and decentralized physical infrastructure networks (DePIN) has been continuously topped by meme coin trading throughout 2024.

From the end of 2023 to the present, meme coins have done incredibly well, outperforming hundreds of tokens representing nascent Web3 protocols providing services and building utilities, and many are asking why.

i understand why memecoins can have a moment.

— 0xDesigner (@0xDesigner) June 11, 2024

but how is it *still* the dominant narrative?

every cycle has expanded the functionality and reach of crypto:

+ decentralized, tamper-proof money

+ p2p, cross-border payments

+ programmable money

+ permissionless financial…

This article from Lever.io, will look at the staying power of memes in Web3 by examining a brief history of meme coins over a decade and the Web3 infrastructure that supports their trading on the market.

In our next article on meme coins, we'll explore the latest trends, including how influencer marketing factors into the equation in the new attention economy.

Meme Coin History from Doge to Ethereum DEXs

Meme coins, which attempt to financialize humor and culture, stand out in the colorful spectrum of cryptocurrency and Web3. Originating from the rich soil of internet memes, these crypto assets have leaped from the screens of social media to the screens of traders worldwide with overnight success.

However, the leap from internet memes to today's $60 billion market cap of easily launched and tradeable assets took years of building and innovation in Web3. In the following section, we provide a quick rundown on how the bricks were laid.

Dogecoin Set the Precedent for All Future Memecoins

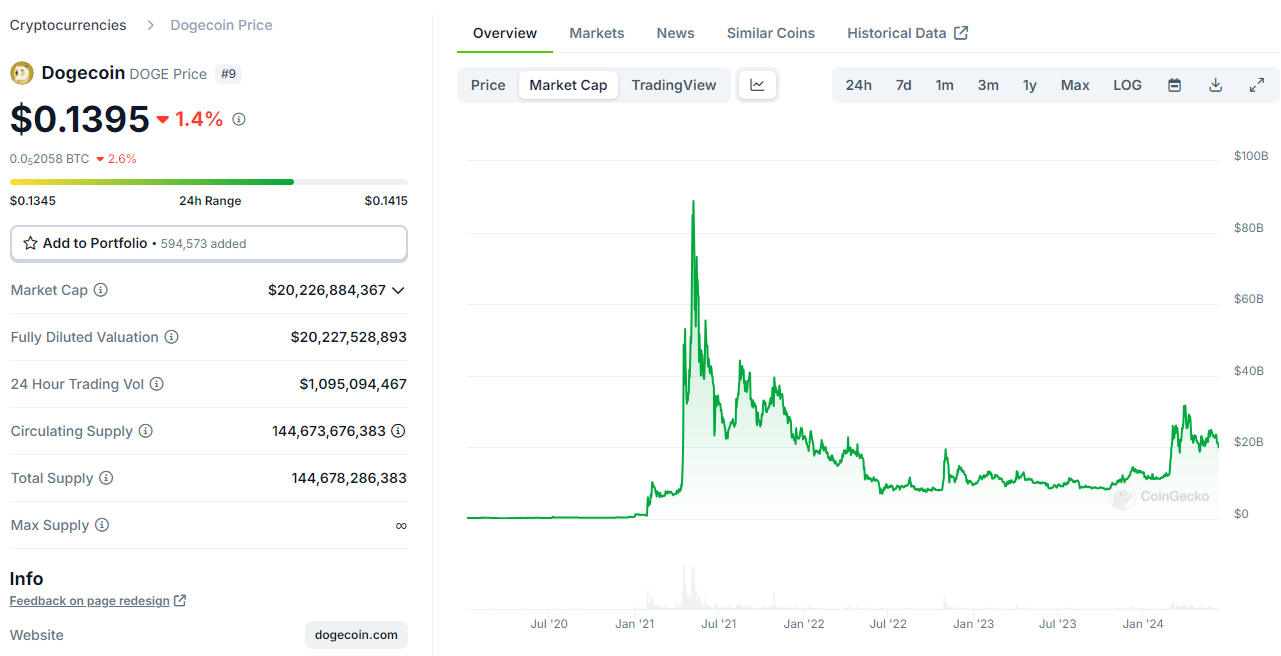

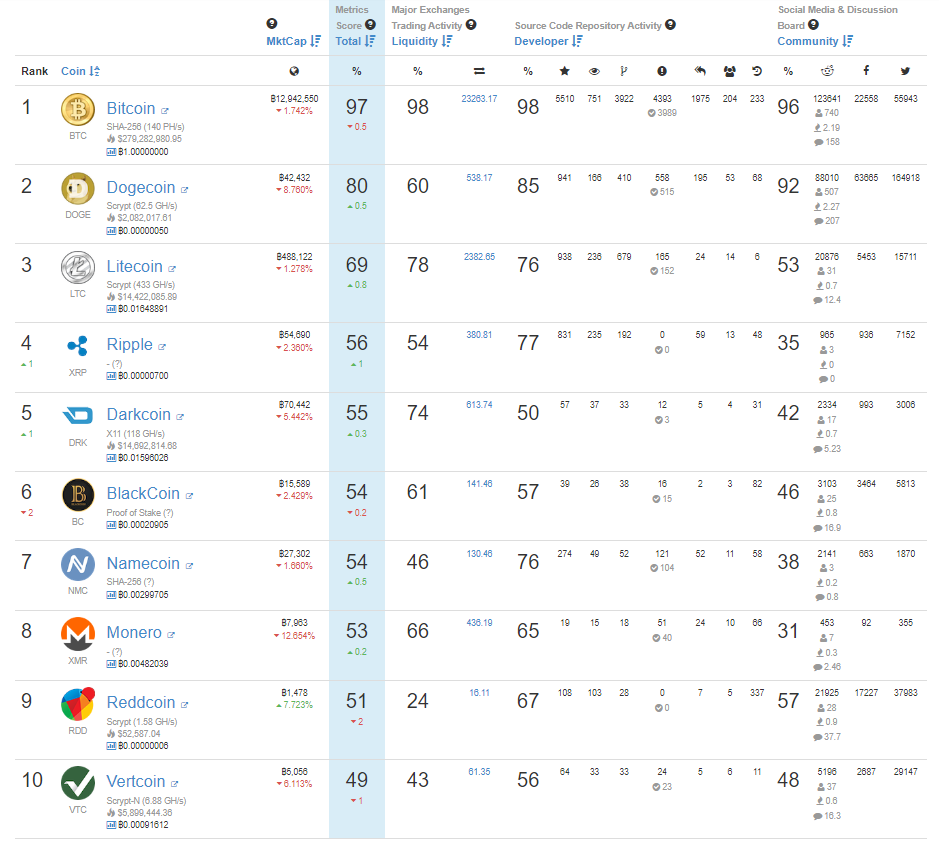

Nearly a decade ago, Dogecoin was launched by forking and rebranding a fork of the Bitcoin network as a Reddit prank. Nowadays, the godfather of dog coins is no joke after reaching a market cap of over $88 billion in 2021 (currently sitting around $20 billion) and cementing itself in crypto's Top 10.

Doge rose from nearly complete obscurity beyond a niche group of Redditors to become the darling of 2021's crypto boom, and at one point 48 mainstream companies accepted Dogecoin as payment, including PornHub, GameStop, and Tesla. The NBA's Dallas Mavericks even accepted Dogecoin in exchange for tickets and merchandise.

While Bitcoin was launched in earnest, Dogecoin was launched in jest. At the end of close, though, Dogecoin was a fun idea that attracted an incredible amount of attention and became a force to be reckoned with in the market, proving that a lowly meme could serve a similar use case as the prestigious BTC.

Ethereum Created a Platform for Meme Coin Sales

Programmable blockchains were the first step toward meme coin madness. With the 2015 launch of Ethereum and the ERC-20 token standard, it became possible for anyone to launch a new token without launching a whole new blockchain.

The first real expression of the market's interest in ERC-20 tokens exploded with the ICO boom of 2017-2018 and a somewhat premature enthusiasm for Web3. Billions of dollars exchanged hands as fundraising for decentralized projects—the vast majority of which no longer exist today—piled into Initial Coin Offerings.

It could be said that many of the tokens associated with ICOs can be regarded as meme coins of a bygone era. What does that mean?

With very little in the way of Web3 technologies or businesses still standing from the fundraising of that initial boom, ICO tokens represented more social and community alignment with ideas than they actually represented projects building applications and infrastructure.

Tokens sold as fundraising for a dog walking dApp, along with thousands of Web3 projects that no one bothered to build, essentially held as much intrinsic value as a picture of a dog—a meme.

DEXs Launched the Ultimate App for Trading Meme Coins

Early token trading was basically a nightmare. If users wanted to buy Doge with BTC, they had to trade through a centralized exchange (CEX) that custodied assets from multiple chains...and often ran away with those assets, or users could trade over the counter (OTC) and hope a counterparty would honor a deal.

Until the launch of Ethereum, everyone was pretty much speculating on "the future of money" by trading gas tokens from different Layer 1s, many of which were modified forks of Bitcoin. The ERC-20 standard changed everything by creating a way to program tokens that could be traded on the same network.

Then, what really made it possible for the modern degen to swap ERC-20 USDC for ERC-20 meme coins was a key piece of DeFi infrastructure, the decentralized exchange (DEX). In 2018, Uniswap v1 broke new ground by launching its automated market maker (AMM) and DeFi's first true DEX.

Uniswap's AMM relied on liquidity pools and an equation that could independently compute the price tokens (x*y=k), allowing anyone to instantly create a market for any ERC-20. Uniswap's DEX made it possible for memecoins to really flourish, because new tokens no longer had to be onboarded onto a CEX for users to start trading.

Yield Farming and Meme Coins on Ethereum Exploded in 2021 until Things Fell Apart

:max_bytes(150000):strip_icc()/what-is-yield-farming-7098519-final-90f5d5a5a98a4c769f8ed77d6334768b.png)

The DEX made it possible to quickly mint and swap tokens. One problem was that these new tokens had to be pooled with tokens that already had an established value, like stablecoins, ETH, or wrapped BTC. New tokens are valuable because they can be swapped for other valuable tokens in the opposite side of their pool.

The question became: How could protocols get users to pair their new governance tokens with stablecoins or ETH in AMM liquidity pools? The answer was liquidity mining, otherwise known as yield farming.

Yield Farming Became the Biggest Thing in DeFi

The immediate ability to acquire new tokens and trade them for other tokens with more enduring value, like USDT or ETH, ramped up the market's FOMO (Fear of Missing Out). DeFi developers were more than willing to feed this appetite.

- What the market needed was tokens to trade on a DEX, and these tokens were heavily supplied by yield farming.

- What developers with tokens needed was liquidity for their tokens, and this was also supplied by yield farming.

Compound introduced yield farming in 2020, setting off a wave of other token generation events that rewarded users for supplying liquidity on a DeFi platform.

How it worked: By supplying liquidity on a borrow/lend platform or a DEX (by pairing the token with stablecoins or ETH), you earned the platform's governance token, which could be used to vote on future changes or sold on the market.

When Sushiswap copied Uniswap's code and provided SUSHI rewards to liquidity providers, over a billion dollars worth of liquidity moved from Uniswap, which had no token, to Sushiswap. After Sushiswaps "vampire attack" proved to be such a success, every protocol launched a token, including Uniswap, and yield farming became ubiquitous.

Yield Farming Abstracted DeFi Tokens Into Pure Meme Coin Mania

It soon became clear that the DeFi community had a voracious appetite for "yield" of any kind. Overnight, DeFi developers began launching new protocols with tokens and rewarding users with 10,000% APYs for providing liquidity on their platform.

Yield farming transformed from a way for protocols to bootstrap liquidity into a shell game where hundreds of millions of dollars moved from older protocols to newer protocols with a shiny new token.

Many of these "protocols" copied and pasted open source code, created a new UI, and launched a token that would eventually get traded to zero.

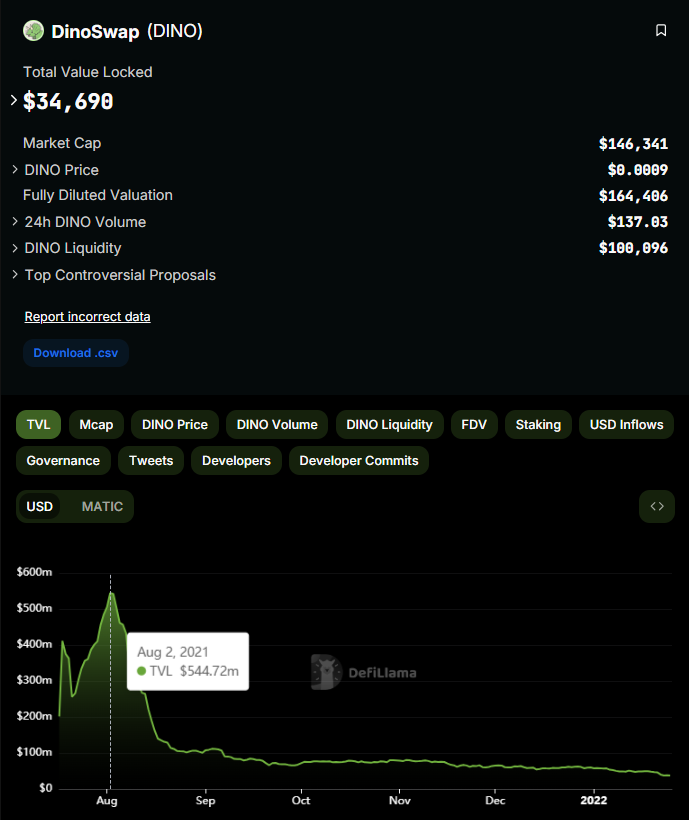

What began as a revolution in finance soon devolved into a game of financial chicken. Increasingly, "toxic liquidity" moved from one protocol to the next, usually within 48 hours, draining liquidity pools of USDC, filling pools with more worthless tokens, and moving TVL (Total Value Locked) around the ecosystem.

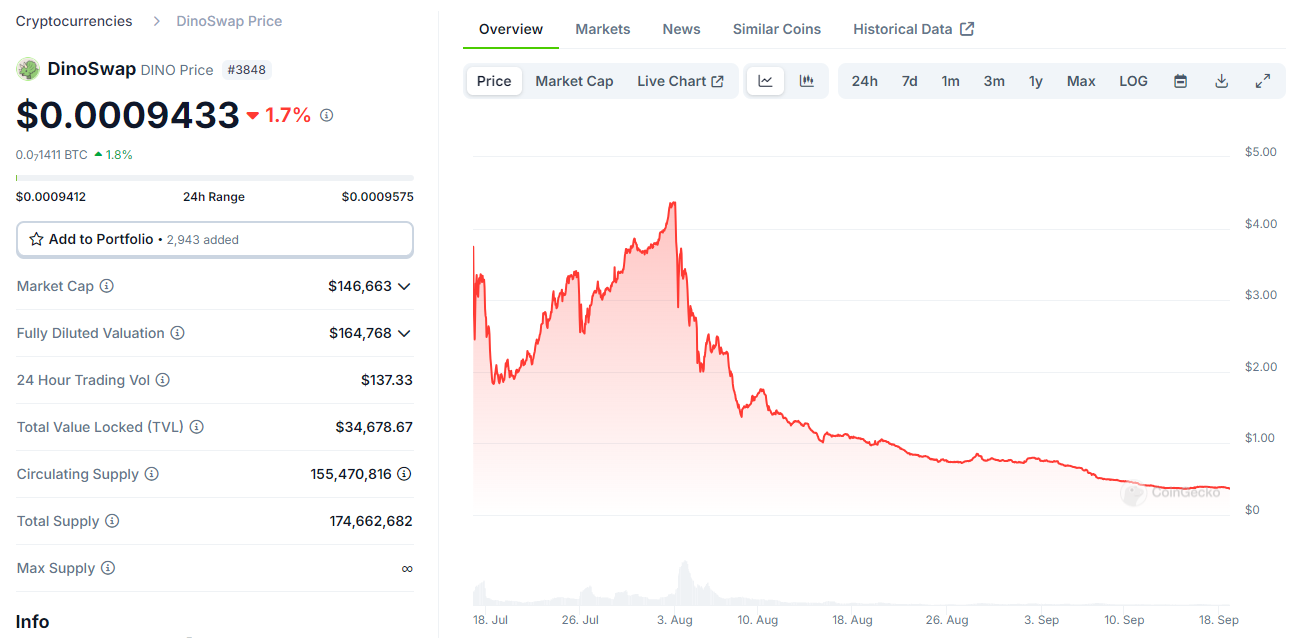

For example, a DEX launched on Polygon in the middle of a bull market managed to attract over $500 million in liquidity while offering rewards paid in DINO tokens. Notice how quickly liquidity moved in and out of DinoSwap.

Essentially, the charts for a majority of DeFi protocol governance tokens began to resemble the historical charts for meme coins—because a majority of these DeFi tokens were meme coins.

The Market Showed Extreme Love for Dog Meme Coins on Ethereum

While DeFi tokens were trading like memes, so were actual memes. Throughout the DeFi Summer of 2020, billions of dollars pumped into DeFi platforms on Ethereum, but this liquidity couldn't easily move into trending tokens like DOGE, since Ethereum and Dogecoin are two different networks.

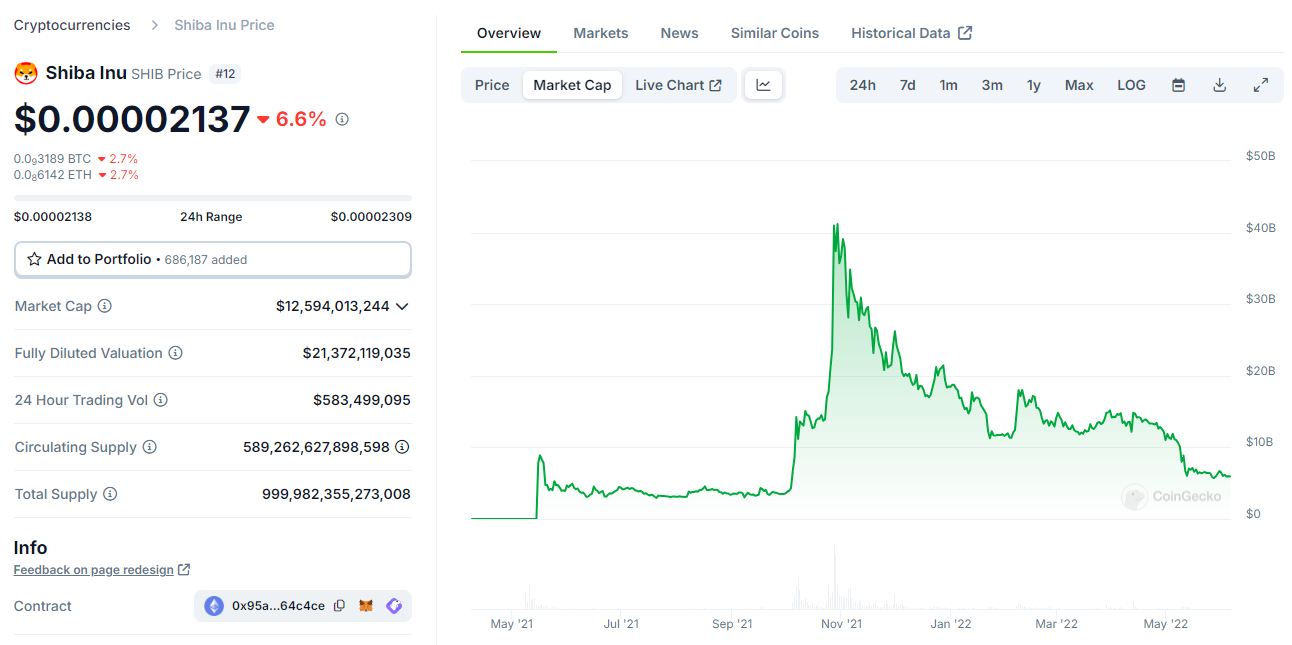

Still, the people want their dog coins! Shiba Inu (SHIB), which launched on Ethereum, gave users an outlet for participating in dog-themed tokens that had zero relationship to a protocol with Web3 utility beyond memetics.

In an incredibly chad move, Shiba Inu's devs sent 50% of SHIB's supply to Vitalik Buterin, a Co-founder of Ethereum and one of its biggest influencers; it was a brilliant marketing move, drawing the community's attention to SHIB.

Vitalik burned 90% of the SHIB sent to his wallet and donated the rest to COVID relief in India. A few months later, SHIB reached an ATH with an impressive $40 billion market cap.

Solana's BONK and Ethereum's PEPE Meme Coins Launch Highs into 2023's Bear Market Depths

Crypto bull markets run in cycles, and SHIB's run to $40 billion and its subsequent fall mirrored the rest of the crypto market's drawdown. Liquidity fled from memecoins during crypto winter and for all of 2022, yet two tokens punched through the charts in 2023, signaling better things to come.

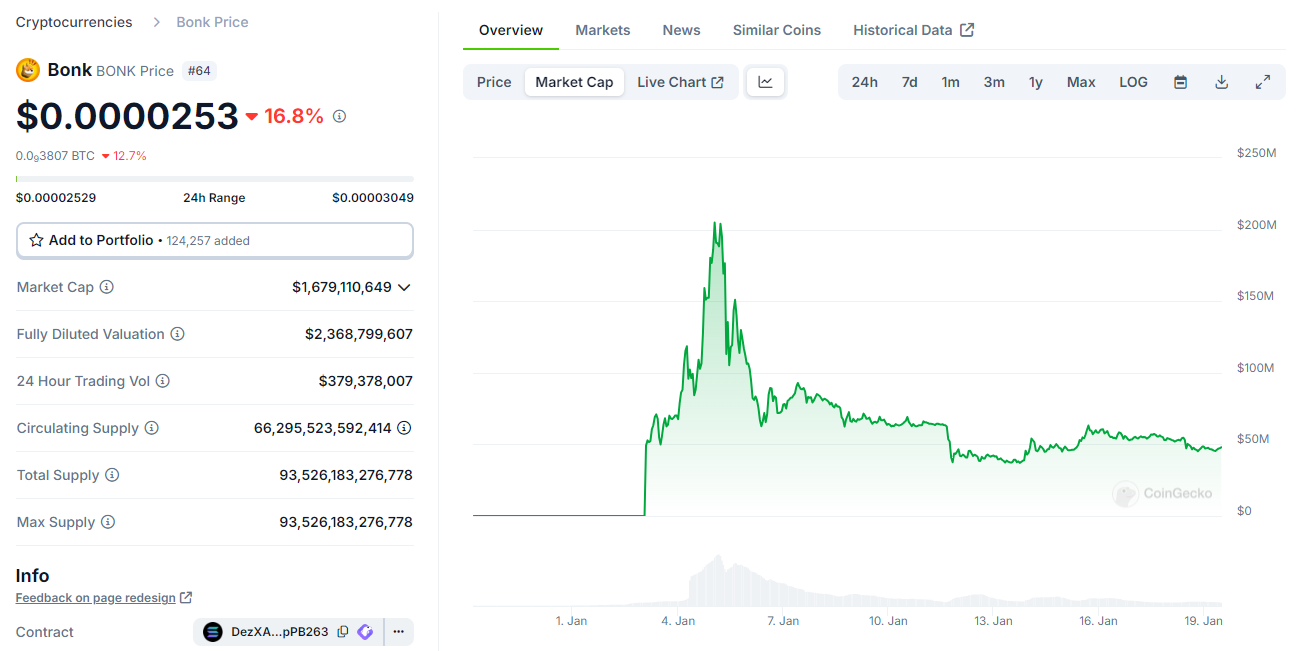

Bonk Inu

Bonk Inu was a meme coin that mysteriously appeared in Solana wallets around Christmas 2022, when Solana was trading around $10, and sentiments were at their lowest. Solana's newest dog token quickly rose up the charts, and BONK reached a $200 million market cap at the bottom of the bear market.

Pepe

In the Ethereum ecosystem, PEPE began its rise up the charts in spring 2023. Another bear market miracle, PEPE unexpectedly ate multiple zeros and climbed over $1.5 billion in market cap.

Both Bonk Inu and Pepe showed that the market was still interested in meme coins, but it took until the latter half of 2023 for BTC to wake up and lift the rest of the market with it. Then, in late 2023, memecoins began their epic runs yet again, and the "attention token" meta began to take hold.

Next Time: The Meme Coin Explosion of Madness in 2024

As we close out this article, it's essential to recognize the broader implications of the meme coin phenomenon within the Web3 ecosystem. Meme coins, initially perceived as fleeting jokes, have now firmly entrenched themselves as significant drivers for mass adoption in crypto.

Their success underscores a crucial aspect of modern digital economies: the power of community, cultural narratives, and grabbing users' attention. Meme coins, more than just speculative assets, have become "attention tokens" that capture and hold the collective imagination.

Stay tuned with Lever.io as we explore the latest trends shaping the meme coin landscape in our next article, including the pivotal role of influencer marketing in the new attention economy in 2024.